by Ethan Faverino | Mar 9, 2026 | Must Read, News

By Ethan Faverino |

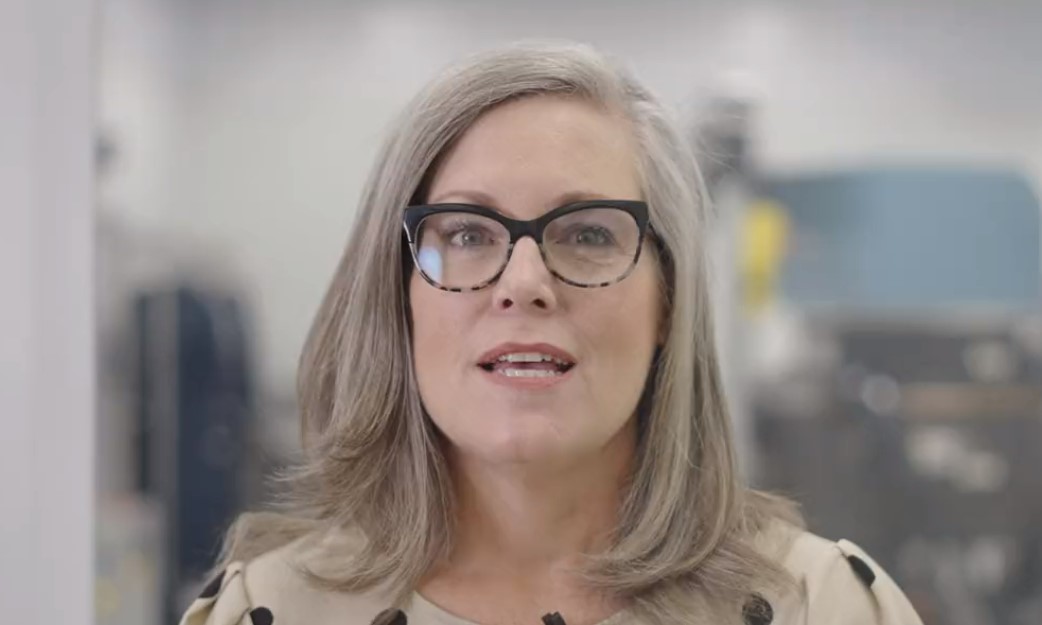

Arizona State Senator Jake Hoffman (R-LD15) strongly condemned Governor Katie Hobbs for vetoing SB 1439, a measure he sponsored that would have authorized an optional specialty license plate to honor the late Charlie Kirk and support related efforts.

In her veto letter, Governor Hobbs stated that the legislation “inserts politics into a function of government that should remain nonpartisan.”

Governor Hobbs just vetoed a specialty plate “For Charlie” that was passed by the Arizona Legislature,” tweeted Turning Point Action’s CEO Tyler Bowyer. “They’re very worried about Arizonans wanting to support the cause of Charlie.”

Hoffman, who is closely associated with Turning Point, called this reasoning hypocritical, deeply disappointing, and inconsistent with Arizona’s long-standing tradition of recognizing individuals and causes through state designations, including specialty license plates.

“Katie Hobbs’ grotesque partisanship knows no bounds,” stated Senator Hoffman in a press release condemning the Governor’s decision. “Even in the wake of a global civil rights leader — an Arizona resident and her own constituent — being assassinated in broad daylight for his defense of the First Amendment, Hobbs couldn’t find the human decency to put her far-left extremism aside simply to allow those who wish to honor him to do so. Katie Hobbs will forever be known as a stain on the pages of Arizona’s story.”

Senator Hoffman highlighted the inconsistency in Hobbs’ position, noting that Arizona has historically honored public figures across the political spectrum without similar objections. “It’s absolutely absurd for Hobbs to suddenly claim that honoring someone through a state recognition is ‘too political.’ Arizona highways, buildings, and memorials have been named after elected officials and public figures for decades,” added Senator Hoffman. Congressman Ed Pastor, a proud Democrat, has a freeway named in his honor. No one suggested that recognition was inappropriate simply because he held political views.”

Arizona currently offers dozens of voluntary specialty license plates supporting various causes and organizations, allowing drivers to opt in and contribute if they choose. SB 1439 would have provided the same opportunity to honor Kirk.

“Charlie Kirk inspired millions of young Americans to engage in their communities, exercise their First Amendment rights, and participate in our democratic system,” continued Hoffman. “Hobbs’ veto sends a chilling message that honoring someone who championed free speech is unacceptable if their views do not align with her political ideology. This was a simple, voluntary way for Arizonans to honor a man whose life’s work centered on civic engagement and the peaceful exchange of ideas. Katie Hobbs chose petty politics instead.”

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Mar 7, 2026 | News

By Ethan Faverino |

In a display of strong bipartisan support, the Arizona Senate unanimously advanced legislation designed to crack down on deed fraud and better protect property owners statewide.

On Tuesday, the Senate passed SB 1479, sponsored by Majority Whip Frank Carroll (R-LD28), and sent the measure to the House for further consideration.

With deed fraud schemes growing more complex and repeatedly targeting vulnerable homeowners, lawmakers are acting to close dangerous loopholes in Arizona’s real estate recording system.

The bill updates statutes to improve identity verification, increase transparency, and impose stricter penalties on those who exploit the system for fraudulent purposes.

SB 1479 requires individuals submitting deeds or related documents in person at a county recorder’s office to present valid photo identification, with exemptions provided for trusted entities such as escrow officers, title insurance agents, banks, credit unions, active members of the State Bar of Arizona, and governmental entities. Recorders may note identification details in the system, but are prohibited from retaining copies of the identification, and this information remains non-public and exempt from disclosure.

“Property ownership is one of the most basic rights Arizonans have, and protecting that right should never be controversial,” stated Carroll. “When criminals can forge documents, quietly transfer property, or exploit weak safeguards, it puts families, seniors, and small businesses at real risk of losing what they worked their entire lives to build.”

The legislation also directs county assessors to establish a voluntary notification system by January 1, 2027, enabling property owners to opt in for prompt alerts—via email, text message, or similar means—whenever changes are made to ownership or mailing address information.

Additionally, the bill strengthens affidavit requirements for deeds and contracts transferring title by requiring the inclusion of mailing addresses, telephone numbers, and optional contact details such as email addresses for buyers and sellers.

For high-risk real property documents—including deeds, quitclaim deeds, deeds of trust, and power of attorney affecting real property—notaries must obtain a thumbprint in their journal, with exceptions for foreclosure-related trustee’s deeds, releases, and certain compliant remote notarizations that include retained audiovisual recordings for at least seven years.

The measure repeals outdated provisions, increases penalties for recording forged documents, and makes clear that property fraud carries serious criminal consequences.

“This legislation restores trust in our system by strengthening identity verification, improving transparency, and holding bad actors accountable,” added Carroll. “The unanimous vote shows that protecting property owners isn’t partisan—it’s common sense. Arizona is sending a clear message that we will stand with rightful owners and will not allow fraudsters to game the system.”

As concerns over property scams continue to rise across the state, SB 1479 represents a proactive effort to ensure Arizona’s recording processes prioritize legitimate owners and deter fraud at every stage.

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Mar 6, 2026 | News

By Ethan Faverino |

In response to recent controversies surrounding state contract awards under Governor Katie Hobbs’ administration, the Arizona Senate has approved legislation to strengthen oversight, prevent potential political favoritism, and protect taxpayer funds.

SB 1186 introduces mandatory disclosure requirements for companies applying for state contracts via Requests for Proposals (RFPs) or seeking certain state grants.

Under the bill, applicants must report any “thing of value” provided within the preceding five years. This includes anything given—directly or indirectly—by the company, its officers, directors, or their family members to the Governor; entities controlled by the Governor (such as campaign committees, joint fundraising committees, or inaugural funds); or organizations advocating for the Governor’s election or opposing their opponents, including political committees or nonprofits that make independent expenditures.

These disclosure obligations extend to companies currently holding state contracts, promoting ongoing transparency during the term of taxpayer-funded agreements. The bill also amends procurement record retention rules by prohibiting the destruction of notes taken during RFP evaluations. If such notes are destroyed in violation of the provision, related contracts awarded after the effective date may be resolicited.

The legislation addresses documented concerns from high-profile cases, including the Sunshine Residential Homes controversy—where the group home operator received a significant rate increase from the Department of Child Safety following substantial political donations tied to Governor Hobbs—and issues with a multibillion-dollar Arizona Health Care Cost Containment System (AHCCCS) Medicaid contract award.

In the latter, an administrative law judge highlighted serious flaws in proposal evaluation, scoring, fairness, and record-keeping, prompting questions about the integrity of the state’s procurement practices.

“What we have seen under the Hobbs administration exposed serious weaknesses in how state contracts are awarded and monitored,” stated bill sponsor President Pro Tempore T.J. Shope (R-LD16). “When billions of taxpayer dollars are involved, transparency cannot come after the fact. The public deserves to know who is seeking state contracts, what relationships exist, and whether decisions are being made fairly before money goes out the door. This legislation closes those gaps by requiring disclosures upfront, preserving critical records, and creating clear accountability standards so Arizonans can have confidence that contracts are awarded based on merit, not political connections.”

Supporters argue that SB 1186 modernizes oversight by focusing on pre-award transparency, in contrast to post-award reporting proposals. The bill amends Title 41 of the A.R.S., adding sections on disclosures for contracts and grants while strengthening record retention in procurement.

The measure now heads to the Arizona House for further consideration.

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Mar 5, 2026 | News

By Ethan Faverino |

The Biggs for Arizona campaign has announced that it has filed more than 20,000 ballot nomination signatures with the Arizona Secretary of State’s Office—nearly three times the minimum required for Republican candidates. The strong showing should ensure Congressman Andy Biggs will qualify for the July 2026 Republican primary ballot for governor.

The filing marks the highest number of nomination signatures submitted by any candidate for any office in 2026 to date, underscoring the campaign’s strong grassroots momentum.

Rep. Biggs has emerged as the only current Republican candidate leading in polls for the GOP primary, consistently holding double-digit advantages over his opponents in third-party surveys conducted since September 2025. Polls from GrayHouse, Emerson College, and Pulse Decision show him ahead by 41, 42, and 28 points, respectively—all with three Republican candidates in the field—and he has not trailed any current primary opponent in any published poll.

“Cindy and I are incredibly grateful for every volunteer and supporter who stepped up to help us collect over 20,000 signatures in support of our campaign,” stated Congressman Andy Biggs, announcing his 20K ballot qualification signatures. “It’s a testament to the grassroots nature of our campaign that we hit this monumental number without the need for paid canvassers or digital advertising for signatures. Arizonans are tired of the weak and ineffective Katie Hobbs and are ready for a leader to restore the American Dream in our state. We’ve got a lot of work to do as a campaign, but we’re very excited to hit this first major milestone.”

Rep. Biggs stands as the only candidate in the Arizona Republican gubernatorial primary endorsed by both President Trump and the late Charlie Kirk. He has also secured endorsements from Turning Point CEO Erika Kirk, Arizona Congressmen Eli Crane (R-AZ02) and Paul Gosar (R-AZ09), Maricopa County Board of Supervisors Debbie Lesko and Mark Stewart, as well as 33 current and former state legislators.

Financially, Rep. Biggs has demonstrated consistent momentum throughout 2025, setting multiple personal fundraising records in Q2, Q3, and Q4. He leads all Republican gubernatorial candidates in the cycle with $1.9 million raised and $782,000 cash on hand.

Congressman Eli Crane praised the effort, saying, “From the first day of the campaign, Congressman Biggs and his supporters have done a great job of taking their message of Restoring the American Dream to voters across Arizona. The rural Arizonans I represent are supporting Congressman Biggs because he’s a man of principle that will get things done for our state without compromising his conservative values. He’s the best choice to defeat Katie Hobbs in November, and I urge all Republicans to unite behind his campaign now.”

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Mar 3, 2026 | News

By Ethan Faverino |

Yuma Sector Border Patrol Agents have arrested a cartel smuggling scout operating in the remote Sierra Pinta Mountains. The apprehension, resulting from an ongoing investigation by the Yuma Sector Targeting and Intelligence Division, disrupts cartel reconnaissance efforts that facilitate the illegal movement of aliens through the Wellton Station Area.

Cartel scouts position themselves at high vantage points in the rugged mountain terrain to monitor law enforcement activities, including the movement of Border Patrol agents and Air and Marine Operations assets.

By maintaining extended surveillance—often living in the mountains for days—these scouts enable smuggling organizations to evade detection and coordinate illegal crossings.

During the operation, agents located the suspect at a scouting site equipped for prolonged missions. A search revealed food supplies, sustainment gear, and a solar panel used to power batteries for surveillance and communications equipment.

Acting Chief Patrol Agent Dustin Caudle stated, “The arrest of this dangerous smuggler is a perfect example of a unified border enforcement team working together to achieve a successful law enforcement outcome. These ruthless transnational criminal organizations have no regard for human life, and the dismantling of these cartel networks ensures a secure border that increases the safety of agents and our communities.”

The subject, who has two prior expulsions under Title 42, was transported to Wellton Station for processing and record checks. The individual will face prosecution by the U.S. Attorney’s Office for the District of Arizona and eventual removal proceedings.

The Yuma Sector intends to pursue sentencing enhancements related to scouting activities in support of transnational criminal organizations. The subject is being charged with illegal entry under 8 U.S.C. § 1325, with potential enhancements for scouting at sentencing.

The Yuma Border Patrol Sector Prosecutions Unit collaborates closely with the U.S. Attorney’s Office to seek the maximum application for offenses involving transporting and harboring illegal aliens in the United States.

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.