by Ethan Faverino | Mar 2, 2026 | Education, News

By Ethan Faverino |

Arizona Senate Republicans are moving forward with legislation to strengthen school safety and emergency preparedness statewide, advancing a measure to allocate $3.2 million for enhanced communication and coordination during school emergencies.

The bill, SB 1582, cleared a key committee hurdle and is now headed toward a full Senate vote, with Republicans emphasizing their commitment to student protection amid unanimous Democratic opposition.

Sponsored by Senator Kevin Payne (R-LD27), SB 1582 appropriates $3.2 million from the state general fund in fiscal year 2026-2027 to the Arizona Department of Education for the school safety program established under A.R.S. § 15-154. The funding supports initiatives to improve interoperability and communication systems between schools, law enforcement, and first responders.

“This is exactly the kind of proactive, commonsense action that Arizonans expect from their Legislature,” stated Senator Payne in a recent press release announcing the advancement of school safety funding. “SB 1582 provides funding to enhance communication between schools and law enforcement, which is crucial for effective emergency response.”

“Republicans supported this bill because protecting children should never be a controversial issue. The fact that every democrat voted against it speaks volumes, but it won’t deter us from doing what’s right for students, parents, and educators across the state,” Payne added. “Voting against funding that improves school safety and emergency response is not principled; it’s irresponsible. When politics takes precedence over protecting children, lawmakers fail the very communities they were elected to serve.”

The bill updates requirements for communication systems funded through related programs, ensuring they are compatible, reliable, and effective during crises. It also allocates funding to the Arizona Department of Administration (ADOA) for the School Safety Interoperability Fund, strengthening coordination and promoting safer learning environments across the state.

Senator Mark Finchem (R-LD1), a retired law enforcement officer, expressed frustration with the Democratic opposition. “In the realm of public safety, there are no second chances; when communication fails, people can get hurt or even killed. SB 1582 would provide practical tools to help first responders during a school emergency.”

“Yet today, democrats chose to vote no. Tomorrow, they’ll likely use ‘school safety’ as a talking point when it’s politically convenient or when they want to score rhetorical points against common-sense policies,” continued Finchem. “This is not leadership; it’s hypocrisy. You cannot oppose funding that protects children and then claim the moral high ground. When it’s time to take action instead of just talking, their priorities are clear, and Arizona families deserve better.”

SB 1582 now awaits a full Senate vote.

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Mar 1, 2026 | News

By Ethan Faverino |

In a decisive step to strengthen voter confidence and streamline Arizona’s election processes, the Arizona House of Representatives passed HCR 2016, a proposed constitutional amendment sponsored by Representative Rachel Keshel (R-LD17).

HCR 2016 seeks to require in-person voting to take place exclusively at designated precinct polling places, eliminating the use of countywide voting centers, emergency voting centers, and on-site early voting locations.

If approved by voters in the upcoming election, the resolution would cap election precincts at no more than 2,500 registered voters at the time precincts are designated. It would also remove statutory authority for voting centers and related provisions in election administration, electioneering, and unlawful acts statutes.

“Arizonans want elections they can understand, observe, and trust, and the precinct model delivers that,” stated Rep. Keshel. “HCR 2016 puts Election Day voting back where it belongs: at clearly designated polling places tied to precincts, with reasonable precinct sizes that are easier to staff and manage. Voting centers and last-minute location changes create confusion, weaken consistent procedures, and slow results. This helps restore faith in our elections for Republicans, Independents, and Democrats who expect clear rules and timely results.”

The resolution would end the option for in-person voting at on-site early voting locations through 7:00 p.m. on the Friday before an election and eliminate references allowing on-site tabulation of early ballots at voting centers.

House republicans advanced HCR 2016 as a key priority under the House Republican Majority Plan to secure elections by reinforcing the structure of in-person voting and empowering Arizona voters to decide the issue directly at the ballot box.

The measure aligns with broader efforts to ensure fast, accurate ballot counting for timely results, protect election integrity, and promote transparency.

Secure elections remain a top focus for Arizona Republicans, who emphasize that voters deserve free, fair, and transparent processes where ballots are counted quickly and results are known sooner. HCR 2016 supports these goals by addressing structural elements that contribute to delays and confusion in election administration.

The measure now advances to the Arizona Senate for further consideration.

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Feb 28, 2026 | Economy, News

By Ethan Faverino |

As the 2026 Cactus League Spring Training season kicks off, bringing fifteen Major League Baseball teams to ten stadiums across the Valley, a comprehensive new analysis from the Common Sense Institute (CSI) highlights the significant economic benefits of this annual tradition.

The report estimates that the season, running from February 20 through March 24 with 225 scheduled games, will generate between $210 and $953 million in GDP for Arizona, driven primarily by new spending from out-of-state visitors.

“Spring training is when Arizona’s tourism industry truly steps up to the plate,” wrote Katie Ratlief, Executive Director of CSI. “Each February and March, fans from across the country bring new spending into our hotels, restaurants, and small businesses — supporting jobs, generating tax revenue, and driving measurable economic growth.”

According to the CSI and Cactus League, an estimated 1.8 million fans are expected to flock to venues all over the Valley. About 65% of attendees are projected to come from outside Arizona, injecting fresh dollars into the state’s economy.

Out-of-state visitors—including fans, players, coaches, team staff, and their companions—are anticipated to spend between $210 million and $590 million directly on categories such as lodging, restaurants and bars, groceries, in-state transportation, and game tickets. Key spending breakdowns include:

- Hotels: $74 million to $335 million

- Restaurants and bars: $46 million to $105 million

- Groceries: $23 million to $52 million

- Transportation: $10 million to $45 million

- Game Tickets: Approximately $52 million

This direct spending is expected to ripple through the economy, resulting in:

- Total business sales output: $341 million to $1.6 billion

- GDP Boost: $210 million to $953 million

- Personal income increase: $46 million to $556 million

- Disposable personal income boost: Up to $486 million

- Jobs supported statewide: 668 to 9,697

The report notes that, for the first time, favorable conditions—including strong attendance and potentially higher per-visitor spending—could push the overall economic impact beyond the $1 billion mark this year.

The influx is also projected to generate between $12 million and $33 million in additional State Transaction Privilege Tax (TPT)—Arizona’s equivalent of sales tax—providing a further boost to state and local coffers.

“Arizona’s strong policy environment and world-class quality of life make it possible to attract major recurring events like the Cactus League,” added Ratlief, “and it is a big part of why tourism is a consistent and powerful contributor to our state’s economy.”

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Feb 27, 2026 | Economy, News

By Ethan Faverino |

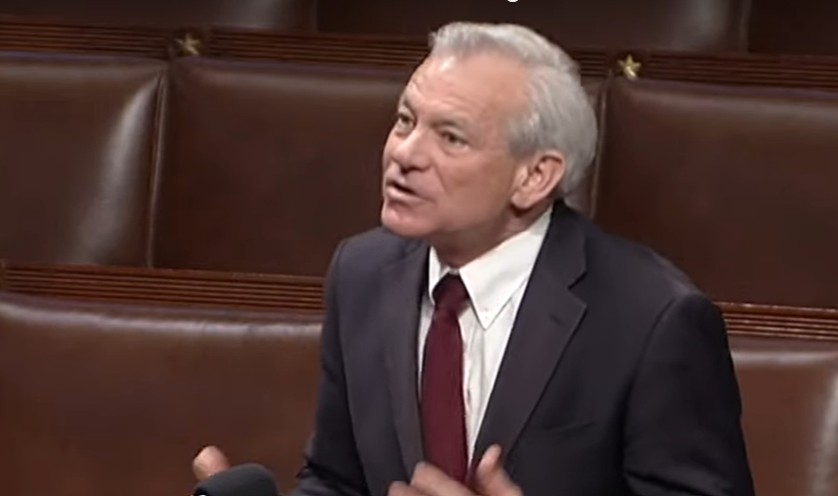

In response to the U.S. Supreme Court’s February decision in Learning Resources, Inc. v. Trump, which held that the International Emergency Powers Act (IEEPA) does not authorize the President to impose tariffs, Joint Economic Committee (JEC) Chairman David Schweikert (AZ-01) issued a statement encouraging a shift toward a more stable and growth-oriented tax framework.

In a 6-3 ruling, the Supreme Court invalidated sweeping tariffs imposed under IEEPA, concluding that the statute does not grant the executive branch authority to levy import duties. The Court reaffirmed that Congress holds constitutional authority over tariffs and taxation, rejecting arguments that IEEPA’s provisions governing economic measures during national emergencies extend to imposing duties.

Chairman Schweikert emphasized the broader implications for America’s tax system amid rising federal spending. “As our nation’s spending continues to grow, we must be honest about the math,” he stated. “To sustain essential programs and protect our fiscal health, we need a tax system that produces stable, predictable receipts without stifling growth. Today’s ruling underscores the uncertainty in our current tax framework, uncertainty that limits investment, hiring, and innovation.”

Schweikert advocated for transitioning to a border-adjusted, destination-based cash flow tax (DBCFT) as a superior alternative to tariffs for promoting domestic production and economic competitiveness. “To bring greater stability and competitiveness to our economy, and address tax arbitrage arising from other countries’ tax policies, I believe the U.S. should move toward a border-adjusted, destination-based cash flow tax. In line with the goals of tariffs, a DBCFT supports U.S.-based production and American workers. But tariffs distort markets and reduce overall output. A destination-based cash flow tax achieves these same objectives through a more economically rational, growth-oriented framework.”

He highlighted key advantages of the DBCFT, including immediate deductions for business investments to encourage reinvestment and growth, taxation based on where goods are consumed rather than where they are produced, and border adjustments that tax imports while exempting exports.

This approach, Schweikert noted, discourages offshoring, provides businesses with predictability for long-term planning, and helps ensure stable tax revenues to support increasing federal expenditures.

“I will be holding a hearing on this important topic in the coming weeks,” he added. “America’s long-term prosperity hinges on our ability to keep U.S. companies competitive both at home and globally. A destination-based cash flow tax strengthens that foundation.”

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Feb 25, 2026 | Education, News

By Ethan Faverino |

The Arizona House of Representatives passed HCR 2003, the Protect Girls’ Sports in Arizona Act, on February 23, 2026, in a vote of 32 ayes to 25 nays.

Sponsored by Rep. Selina Bliss (R-LD1), the measure now advances to the Arizona Senate. If approved by the Senate, it would refer the proposed law to Arizona voters for consideration on the November 2026 general election ballot.

HCR 2003 seeks to require schools and athletic associations to designate interscholastic and intramural athletic teams or sports as “males/men/boys,” “females/women/girls,” or “coeducational/mixed,” based on an individual’s biological sex as recorded at birth on the original birth certificate. Teams designated for females would not be open to biological male athletes.

The resolution also includes stronger privacy protections, prohibiting schools and athletic associations from authorizing individuals to use restrooms, locker rooms, shower rooms, or other private athletic facilities not designated for their biological sex, effective January 1, 2027.

The measure restores and strengthens elements of Arizona’s 2022 Save Women’s Sports Act (SB 1165), which faced partial blocks by the Ninth Circuit Court of Appeals, creating uncertainty for schools, families, and athletes.

“Today the House acted to protect fair competition for girls across Arizona,” stated Rep. Bliss. “Women’s sports were created because biological differences matter. When those differences are ignored, girls lose roster spots, scholarships, and opportunities they earned. HCR 2003 gives voters the chance to protect female athletes and establish clear, durable rules for schools.”

Additional provisions of the proposed law include:

- Allowing athletes to participate on teams aligned with their biological sex or on coeducational teams.

- Prohibiting government entities, licensing organizations, accrediting bodies, or athletic associations from taking adverse action against schools or associations that maintain separate teams for female athletes.

- Providing a private cause of action for athletes deprived of opportunities or harmed by violations, including for injunctive relief, damages (including for psychological, emotional, or physical harm), attorney fees, and costs.

- Protecting against retaliation for reporting violations, with similar legal remedies available.

- Applying to public and qualifying private schools serving K-12.

“Court rulings have created uncertainty for schools and families,” Rep. Bliss added. “This referral allows Arizona voters to decide whether girls’ sports should remain for girls. It protects privacy in locker rooms and showers and restores clarity statewide.”

HCR 2003 now heads to the Arizona Senate for further consideration. If approved, it will be on this year’s general election ballot.

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.