by Terri Jo Neff | Oct 22, 2021 | Economy, News

By Terri Jo Neff |

Excitement is growing in northern Cochise County after the announcement that multiple jobs will be created in early 2022 when Excelsior Mining Corp. reactivates the historic Johnson Camp Copper Mine which was first opened in the 1880s about 65 miles east of Tucson.

Johnson Camp Mine has not produced copper ore in nearly a decade but reopening the mine will allow Excelsior to take advantage of copper’s strong price. In turn, the company will use those revenues to pay for a neutralization plant for its newly opened Gunnison Copper Project, which has produced far less copper cathode than it forecasted.

Excelsior’s Gunnison Copper Project situated one mile from Johnson Camp Mine along Interstate 10 opened last year with limited operations. It is expected to produce 125 million pounds per annum of 99.99 percent copper cathode when fully operational, but this year’s goal was only 25 million pounds.

On Oct. 20, Senior VP Robert Winton said the company has produced less than 1 million pounds to date. The problem, according to Winton and CEO Stephen Twyerould, is that carbon dioxide (CO2) has shown up in Gunnison’s in-situ recovery wellfield.

The villain, they say, is calcite, a naturally-present mineral which creates CO2 when it reacts with the leaching solution injected into the wellfield.

Winton says a fix to the CO2 issue has been identified, but it will take months to update the current wells. In the meantime, company officials have decided to make improvements at the Johnson Camp Mine in order to generate higher revenues next year.

The comments by Twyerould and Winton were made during a webinar hosted by Amvest Capital, a New York-based specialist investment management and corporate finance firm focused solely on the natural resource sector.

Johnson Camp Mine and its existing SX-EW plant can provide up to five years of production from its Copper Chief Pit and the Burro Pit, which Winton says have “a lot of near surface copper.” After construction of a new leach pad and issuance of amended state permits, Johnson Camp is expected to commence production in the second half of 2022.

That means Excelsior’s current staff of about 60 (employees and consultants) will need to be bolstered, bringing much needed fulltime jobs to the Benson and Willcox areas.

According to Winton, the presence of calcite was known from geological studies, but the extent of its impact was not understood until production began at Gunnison last year.

“Calcite was certainly understood in the prework, metallurgical costs, and certainly the feasibility study which is fundamentally an acid consumption discussion,” he said. “However, the negative impacts of CO2 and how they really impacted our flow rate was certainly not envisioned and certainly became the fundamental focus of our ramp up challenges.”

The good part, Winton said, is that the calcite reaction can be managed, which is why construction of a neutralization plant funded by Johnson Camp Mine revenues is Excelsior’s immediate focus.

In 2014, the Johnson Camp property was the main asset of Nord Resources, which was forced into court-ordered receivership by creditors after years of underperformance. Then in late 2015, Excelsior Mining obtained the blessing of a Pima County judge to buy out Nord Resources’ assets.

The company then purchased thousands of surrounding acres, including the site where Gunnison Copper Project’s North Star copper deposit is located. But Excelsior officials are not putting all of their eggs in the copper basket.

Last month Twyerould released a preliminary economic assessment of another company asset, the Strong and Harris copper-zinc-silver deposit located on the northside of I-10 a few miles from Johnson Camp.

Twyerould said that if mining is undertaken at the Strong and Harris deposit it would be by traditional open pit, followed by high-grade underground mining of the remaining sulfides at the bottom of the pit. However, he cautioned that it is still too early to know if mining will be feasible.

“Mineral resources that are not mineral reserves do not have demonstrated economic viability,” he said.

Excelsior also has landholdings in the historic Turquoise Mining District, also referred to as the Courtland-Gleeson District, located approximately 30 miles southeast of the Johnson Camp Mine.

Excelsior Mining is using a six-step in-situ recovery process to produce 99.99 percent pure copper cathode sheets. The process starts with a leaching solution pumped through injection wells which have been sunk over the ore body. This is known as the wellfield.

The leaching solution then moves through naturally fractured rock and dissolves the copper. Multiple recovery wells surrounding each injection well then extract the copper-rich solution, also known as pregnant solution.

The fourth step is for the solution to be pumped to the surface for further processing during which copper is extracted from the solution and turned into copper cathode sheets. Finally, the mining solution is recycled back to the well field to be reused.

Throughout the leaching process, Excelsior Mining utilizes differential pumping and natural impermeable barriers to keep the fluids from migrating beyond the wellfield.

by Corinne Murdock | Oct 21, 2021 | Education, News

By Corinne Murdock |

The mother and father of a middle school student, Amy and Shawn Souza, filed a statement of allegations against Peoria Unified School District (PUSD) with the Arizona State Board of Education for attempting to hide reportedly politicized curriculum from them and ignoring their opt-out requests. According to emails shared with AZ Free News, PUSD Director of Social Studies Curriculum and Instructional Specialist Jennifer Mundy suggested that the teacher and school in question, 7th grade social studies teacher Holli Trentowski at Sunset Heights Elementary, disguise or manipulate the curriculum on its face so that inquisitive parents like them wouldn’t look too closely. Mundy deferred to Marla Woolsey, the district’s Executive Director of Curriculum and Instruction, for final say on the matter.

“[Trentowski’s] titles could be toned down a bit. For example, instead of saying ‘Science behind mob mentality,’ she could say ‘The science behind the KKK’s behavior’ or just put Tuesday’s title on Wednesday as well. I’m assuming that she’s teaching about the Ku Klux Klan on Tuesday and following that up with how it’s possible that people could commit the atrocities they did toward African Americans in the South during Reconstruction (and for a century and a few decades afterwards). If kids are thinking, they’ll [sic] on there [sic] own to take it to what happened this past summer as well as what happened at the Capitol a few weeks ago. Analyzing connections and explaining the multiple causes and effects of events past and present are both standards in social studies. The problem does not lie in what Holli is teaching (assuming I’m correct about the path she’s taking this week).”

According to the Souzas’ complaint, PUSD officials attempted to pull a workaround as soon as the Souzas first began to communicate concerns with them about their daughter’s 7th-grade social studies curriculum. Sunset Heights Elementary Principal Rae Conelley even complained about having to meet with the Souzas to discuss their concerns frequently: she stated that she was “going to lose [her] mind.” Conelley also speculated to Mundy and Woolsey that Trentowski was “baiting” the Souzas with her curriculum. “I am going to lose my mind,” wrote Conelley. “If I am off track in my guidance to [Trentowski] please let me know. I almost feel like she’s baiting them now but I’m the one who’s spending time I don’t have meeting with them.”

The Souzas asserted that Trentowski’s curriculum was “developmentally inappropriate and inherently political.” For a section on work conditions in the early 20th century, one of the assigned resources was a graphic, hour-long documentary by PBS on the Triangle Shirtwaist Factory Fire. The 1911 tragedy claimed nearly 150 lives, most of whom were young women and girls.

Despite Trentowski promising to give the Souzas’ daughter an alternative text and place to work, she reportedly gave her the disputed assignment and had her complete it.

The entire ordeal caused the Souzas to remove their children from PUSD. Last week, the Souzas appeared before the PUSD governing board to warn parents and confront the board members about their experience. “We hear all the time at these meetings and from district employees that if you don’t like [the curriculum] opt them out,” said Amy. “We have lost all faith in [the] Peoria Unified School District having the best interest of our kids at heart.”

Free to Learn – a nonprofit organization that advocates for parental rights in education and the removal of political agendas from schools – assisted the Souzas in filing their complaint. In a statement, President Alleigh Marré said that the Souzas’ action should empower other parents.

“By shining a light on this incident with their complaint, Amy and Shawn are setting an example for other parents in Arizona and around the country as they pursue a quality education for their children free of activism,” said Marré. “If parents work within the parameters of the school and follow all the rules, they should see results. Instead, what we saw in Peoria was deceit and an intentional push to keep parents in the dark. At Free to Learn, we want to empower these parents and give them a platform to advocate for their children when all else fails.”

Corinne Murdock is a reporter for AZ Free News. Follow her latest on Twitter, or email tips to corinne@azfreenews.com.

by Corinne Murdock | Oct 20, 2021 | Education, News

By Corinne Murdock |

The Arizona Secretary of State’s office nominated a Phoenix elementary school teacher, Amanda Delphy, for the national John Lewis Youth Leadership Award, due to her classroom activism. Delphy started a “diversity club” at her school and openly teaches her second grade students social-emotional learning (SEL), activism, and “authentic history” primarily focused on black, indigenous, and people of color (BIPOC). SEL is a framework for interpreting and processing subjects – especially complex ones like history or sexuality – through tools like literature, writing, and art to develop certain social and emotional skills. Oftentimes, SEL serves as a vehicle for propagating tenets of controversial concepts like Critical Race Theory (CRT) and social justice. Ultimately, Delphy didn’t win the award – conservative activist C.J. Pearson did last week.

“Amanda Delphy is a second-grade teacher in the West Valley, where she has focused on empowerment through social-emotional practices, conversations about activism, and authentic history lessons that represent BIPOC individuals as powerful,” read the secretary of state’s nomination.

Delphy regularly posts TikTok videos on how she educates her students to understand certain progressive concepts. Most recently, Delphy described how she teaches her second graders about SEL and equity, how Halloween isn’t “culturally responsive” and that the slang term “savage” – used by kids to describe something or someone considered cool for being bold and unbothered by any consequences – is actually offensive to indigenous people. She’s gained over 14,600 followers for her content.

Delphy teaches second grade at Holiday Park School in the Cartwright School District (CSD). The elementary school’s diversity club launched this semester under Delphy’s suggestion; she announced she will lead the club, and has referred to it jokingly as “indoctrination.” Both the school and the district emphasize that SEL is of equal importance to academics.

Delphy claimed in a September video that equity and SEL education in the classroom were necessary to build “future leaders.” Just the day before posting that video, Delphy posted another video lamenting that her students were “very far below grade level.” She explained that her school received a new math curriculum that she liked, but her team was having trouble implementing it due to the students’ capabilities. As a result, Delphy described how she became “extremely escalated,” “frustrated,” and “overstimulated” from trying to teach math to her students. She said that ended the lesson by sharing those feelings with them.

“I just can’t stress enough to always be vulnerable with your kids when you feel like it’s the right time to do so. I didn’t have to tell my kids how I was feeling. I really didn’t,” said Delphy. “But I wanted to because I wanted them to understand that feelings happen and sometimes negative feelings happen too, and even to people like me, who’s a teacher, right?”

SEL and equity are related to Delphy’s teaching moments on how both Halloween and a favorite slang term for kids, “savage,” are problematic.

In a video posted Tuesday, Delphy explained that she told her students she didn’t decorate for Halloween because she didn’t want those who didn’t celebrate Halloween to “feel unsafe or not welcomed.” She also explained that celebrating Día de Los Muertos (Day of the Dead) could result in “cultural appropriation” that would be disrespectful to Hispanics, but said she couldn’t explain what is or isn’t culturally responsive because she “doesn’t identify as Hispanic, Latino, or Chicano.” This video was a follow-up to a similar one at the end of last month, posted as a “reminder” after she’d seen people decorating for Halloween.

In another video posted earlier this month, Delphy complained that one of her second-grade students called cartoon puppies in a video “savage,” inspiring the entire class to do so as well. She explained how she told her students that they were in a “safe space” and therefore they needed to have “honest conversations” about why they couldn’t say the word “savage” in their “safe space.”

“For those of you who don’t know, I’m half Native American and I actually hate that word. [T]here was a huge mass-murdering of Native and indigenous people, hence the population and culture dying the way that it has, and one of the words that were used to label Natives and indigenous people was ‘savages.’ I understand it’s a cool term now, whatever, but no not over here. Don’t bring that negativity over here,” said Delphy. “I let them know where the word ‘savages’ came from and why it hurts me as a Native person. And I told them that my goal is to create a safe space for everyone, and I just wanted to be honest with them and ask them if they could just not use that word in our safe space.”

Delphy added that this wasn’t her pushing an agenda pertaining to social justice or modern liberalism.

“This didn’t push a ‘social justice, liberal agenda,’ as many of you people call it. This was just me being honest about something that was traumatic to my ancestors and people before me and my people now, and my people in the future,” said Delphy. “Don’t be afraid to have those conversations with your students. My kids are eight years old, and they can understand it!”

Delphy also sells educational resources through “Teachers Pay Teachers,” a collective of supplementary curriculum created and sold by teachers to other educators. One of Delphy’s resources summarizes the origins of Thanksgiving, which she claimed was established as a celebration to thank Native Americans for their kindness to the early settlers. In reality, Thanksgiving had to do with a longstanding tradition expressing gratitude to God – Native Americans just happened to be there for one hosted by the early Plymouth colonists.

“What is Thanksgiving?” read the resource. “It is a Holiday that is the fourth Thursday of every November. It has also been told that the Pilgrims came across a tribe of Native people who taught the pilgrims how to hunt and gather so that they could survive. The story continues that Thanksgiving is meant to represent the large celebration that the Pilgrims held for the Natives to say ‘thank you’.”

In history predating the colonial settlements and long after, thanksgivings were regular celebrations thanking God for His blessings such as a good harvest, health, or military victories; in 1798, the Continental Congress proclaimed a national thanksgiving for the Constitution’s enactment. Thanksgiving Day as known to modern America was first called for by the “Mother of Thanksgiving:” a famed women’s rights activist and “Mary Had a Little Lamb” poet, Sarah Josepha Hale, to unite the nation and ease tensions between the North and South – she had the idea from the annual thanksgivings that her family celebrated. President Abraham Lincoln heeded Hale’s call in 1863 as the Civil War raged on – his proclamation called for a “Day of Thanksgiving and Prayer” to occur the last Thursday of November, with no mention of the Native Americans.

Delphy’s presentation characterized the settlers as callous, selfish people who took advantage of Native Americans. The resource also taught that wearing any traditional Native American items, like headdresses, was disrespectful. Delphy has displayed her prioritization of Native Americans over other races to her students. Last week, she wore a shirt that read “The Future Is Indigenous.”

Other resources sold by Delphy teach about Women’s History Month, Black History Month, Indigenous People’s Day, and Native American Heritage Month.

Corinne Murdock is a reporter for AZ Free News. Follow her latest on Twitter, or email tips to corinne@azfreenews.com.

by Terri Jo Neff | Oct 20, 2021 | News

By Terri Jo Neff |

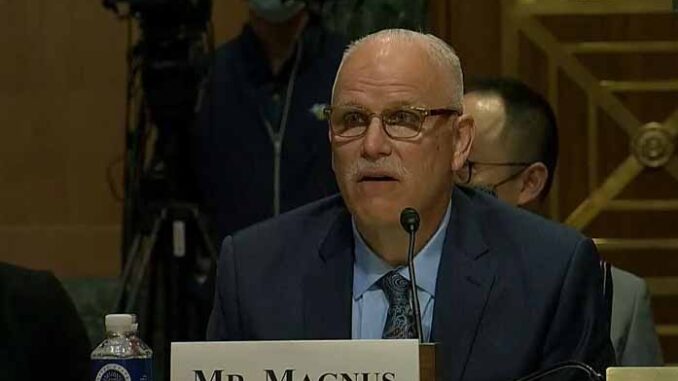

On Monday, Cochise County Sheriff Mark Dannels met with stakeholders about the ongoing crisis at the Arizona / Mexico border. The next day, he took to the airways to explain why two sheriffs’ associations strongly oppose the nomination of Tucson Police Chief Chris Magnus to head the U.S. Customs and Border Protection (CBP).

As Dannels made his comments to KFYI’s James T. Harris, Magnus was in Washington D.C. for a hearing on his nomination put forth by President Joe Biden to become CBP’s next commissioner. The nomination is being championed by Homeland Security Secretary Alejandro Mayorkas, but does not have the support of the National Sheriffs’ Association nor the Arizona Sheriffs’ Association.

“We need a leader there who can lead that organization into the future, not be a political puppet or yes man, not somebody who can say ‘hey this is wrong, it’s broke, let’s put action behind the men and women who are doing their best to solve this border,” Dannels told Harris. “This is not a political issue. This is a righteous issue for leadership, and on behalf of our CBP agents who can’t speak on this, we have a voice for them.”

Magnus has worked in public safety since 1979, always with municipal agencies. He currently oversees about 1,200 employees in Tucson, a city that is not even among the top 30 largest in the country.

By comparison, the San Diego Police Department has nearly 3,000 employees, while the Los Angeles Police Department is comprised of about 12,000 employees, 9,000 of whom are sworn officers.

However, CBP has more than 60,000 employees, including 45,000 sworn employees such as CBP officers assigned at America’s 328 ports of entry as well as U.S. Border Patrol agents.

In his testimony to the Senate Finance Committee on Tuesday, Magnus said he recognized CBP “is a proud agency with a mission that is vital to this country” and that he will expect, without exception, “that all agency personnel be conscientious, fair, and humane when enforcing the law.”

He also testified that he prides himself “on being a pragmatic and bipartisan problem-solver,” and that by working with Congress, the employees of CBP, and its various partners “we can build upon its many strengths to make the agency even better.” His comments skated over the fact TPD has not had a good relationship with CBP during his tenure.

Yet the sheriffs groups focused on Magnus’ qualifications -or lack thereof- to lead a massive organization which is critical to homeland security concerns and to deal with what Dannels calls the “hot mess” of a border that saw a 325 percent increase this year in immigrants arriving at America’s southwest border.

Dannels, whose county shares 83 miles of that border with Mexico, is the president of the Arizona Sheriff’s Association, which represents 14 of the state’s 15 elected sheriffs. He also serves as chair of the border security committee of the National Sheriff’s Association.

According to Dannels, the decision by the National Sheriff’s Association to oppose Magnus’ nomination came only after conducting an interview with the chief.

“Obviously, after the interview, based on his experience, knowledge on the border and CBP and trade, off the past relationship -of which there really hasn’t been a past relationship with border communities by Chief Magnus- and the leadership, we felt that he is not the guy to carry this forward on behalf of CBP,” Dannels told Harris.

The group then sent letters to Biden, Mayorkas, as well as all 100 Senators outlining Magnus’ shortcomings for the job. That move prompted the Arizona Sheriff’s Association to send its own letter detailing the “dire circumstances” at the border and Magnus’ lack of qualifications and poor relationship with CBP.

Magnus’ nomination is supported by Arizona Senators Mark Kelly and Kyrsten Sinema. Any individual or organization may present their views to the Committee by submitting a single-spaced Word document (not exceeding 10 pages) for inclusion in the official hearing record.

The title of the hearing (Consider the Nomination of Chris Magnus, of Arizona, to be Commissioner of U.S. Customs and Border Protection, Department of Homeland Security) and the hearing date (Oct. 19, 2021) must be included on the first page of the statement, along with the full name and address of the individual or organization submitting the statement.

The deadline for submitting a statement is Nov. 2. Statements can be emailed to: Statementsfortherecord@finance.senate.gov or mailed to: Senate Committee on Finance Attn. Editorial and Document Section Rm. SD-219 Dirksen Senate Office Bldg. Washington, DC 20510-6200. There is no fax option.

CHIEF MAGNUS TESTIFIES ABOUT HIS NOMINATION:

by Corinne Murdock | Oct 20, 2021 | News

By Corinne Murdock |

Ron Watkins – a prominent proponent of mass election fraud theories and the ex-administrator of 8chan, the site where the QAnon conspiracy theory originated – announced his run for Arizona’s district one congressional seat last week. He reportedly filed his first FEC report on Sunday.

Watkins recorded a video to announce his run outside of Arizona Attorney General Mark Brnovich’s office, congratulating Brnovich for investigating issues alleged by Cyber Ninjas in their final report of Maricopa County’s election processes. Since relocating to Arizona from Japan this year, Watkins has attempted to meet with Brnovich in person to discuss election fraud.

In his video, Watkins also claimed that the election was stolen from previous President Donald Trump. He promised to fix this by taking down the “dirtiest Democrat” in the “D.C. Swamp”: Congressman Tom O’Halleran (D-AZ-01), who Watkins called “Tom O’Hooligan.”

“I have decided to double down with God as my compass to take this fight to the swamp of Washington, D.C.,” asserted Watkins.

Watkins focused his brief message on rallying support from mainstream Republicans, Trump supporters, and evangelicals.

Watkins’s Twitter account, @CodeMonkeyZ, was suspended on January 8 along with accounts belonging to former federal prosecutor Sidney Powell, and Mike Flynn, the retired Army lieutenant general who briefly served as National Security Advisor for Trump. In a statement, Twitter explained that those accounts and others like them would be permanently suspended for violating their Coordinated Harmful Activity policy.

“We’ve been clear that we will take strong enforcement action on behavior that has the potential to lead to offline harm, and given the renewed potential for violence surrounding this type of behavior that has the potential to lead to offline harm, and given the renewed potential for violence surrounding this type of behavior in the coming days, we will permanently suspend accounts that are solely dedicated to sharing QAnon content,” wrote Twitter.

Watkins has platforms on Telegram and Gab.

The mass Twitter suspensions were part of a sweeping effort to eliminate certain rhetoric and content following the January 6 riot at the Capitol. Less than a week after the incident, Twitter removed over 70,000 accounts.

Certain prominent Republicans also supportive of the mass election fraud theory have run in some of the same circles as Watkins.

Gubernatorial candidate Kari Lake posed for a picture with Watkins last week, which Watkins posted with the claim that they’d shared dinner together. Lake didn’t post the picture. VICE News reporter David Gilbert claimed that Lake had dinner with Watkins, linking to an article he wrote relying on Watkins’s claim. VICE News also included a statement from Lake saying that she didn’t have dinner with Watkins.

In response to Gilbert’s tweet, Lake reiterated that she hadn’t dined with Watkins and that the picture was taken during an outreach event with over 75 voters in attendance. It is unclear if the article was updated after Lake’s tweet – no editor’s note or disclaimer was published.

“Hey Loser, Be a REAL journalist and contact the people you are writing hit-pieces on. I didn’t eat dinner at this event. I spoke with 75+ voters about my plans for AZ. Why are Leftists infatuated [with] this group? I hang out [with] Conservatives all day – no one ever talks about it,” wrote Lake. “I’d recommend an immediate correction to your propaganda piece and an apology to me and the rest of the world for your s****y reporting.”

In August, Watkins attended MyPillow CEO Mike Lindell’s “cyber symposium” discussing mass voter fraud theories, where State Senators Wendy Rogers (R-Flagstaff) and Sonny Borrelli (R-Lake Havasu), as well as State Representative Mark Finchem (R-Oro Valley) took the stage. Watkins has shown great support for Rogers as of late.

Prior to December 2020, Watkins ran a user messaging board site, 8chan, owned by his father, Jim Watkins, and the birthplace of the “QAnon” conspiracy theory. The individual behind it, “Q,” claimed that a secret cabal of Satanic, cannibalistic pedophiles operate a child sex trafficking ring worldwide. Adherents also believe that this cabal and Trump were warring secretly; the cabal worked to undermine the previous president while Trump planned for a massive sting operation of the cabal.

Last week, Watkins announced publicly that QAnon doesn’t exist. Prior to this public denial, some rumored Watkins to be Q – speculations deepened by an HBO documentary released earlier this year.

“The fake news media continues to insist that I am part of some QANON conspiracy. As we all know, there is no QANON,” wrote Watkins. “What does exist are the many hardworking, God-fearing people who are breaking tyranny’s grasp over our Country.”

Controversial content isn’t new for Watkins or his father. The father-son duo were subpoenaed by the House of Homeland Security in 2019 to testify about “violent extremist content” that existed on their platform. Chairman Bennie Thompson (D-MS-02) claimed that there were least three acts of “deadly white supremacist extremist violence” that could be linked to 8chan that year, alluding to three mass shootings that had occurred.

The elder Watkins defended platform content the committee classified as “hate speech” as protected speech under the First Amendment. As for illegal content, Watkins assured the committee that moderators deleted the content as promptly as possible.

Corinne Murdock is a reporter for AZ Free News. Follow her latest on Twitter, or email tips to corinne@azfreenews.com.

by Terri Jo Neff | Oct 19, 2021 | News

By Terri Jo Neff |

When Arizona Attorney General Mark Brnovich met Monday with stakeholders including Cochise County Sheriff Mark Dannels for an updated tour of the Arizona / Mexico border, he learned nothing has improved in the last 10 months.

Brnovich took part in an in-person briefing near Bisbee to discuss options for forcing or cajoling the federal government into acknowledging and then dealing with the border crisis which has seen hundreds of thousands of people from more the 160 countries cross into the southwest U.S. with little success by U.S. Customs and Border Protection officials, including the U.S. Border Patrol, in stopping them.

In an interview with AZ Free News after his border visit, Brnovich said the Biden Administration could make a significant and immediate impact simply by following existing federal laws. That includes deporting the more than 1 million non-citizen convicted felons and others who are the subject an Order of Removal.

Brnovich said deportations could start up very quickly, and would “send a signal that we will enforce our laws.” But instead, the White House continues to incentivize illegal border crossings while signaling “there are no consequences for breaking America’s laws,” he said.

Pushing for deportations is not something new for Brnovich or other state attorneys general. In January, President Joe Biden was asked to reverse an Inauguration Day order imposing a 100-day moratorium on most deportations. Under a 1996 law, such deportations should occur within 90 days of an immigrant receiving an Order of Removal.

According to Brnovich, the Biden deportation moratorium violated a law which went in effect in the waning days of Donald Trump’s presidency to require the U.S. Department of Homeland Security to provide a six-month notice to the State of Arizona before any immigration policies could be changed.

Brnovich also says he is concerned about the long-term effects of such lax immigration laws, which he called “the most important issue” facing the United States. And he worries that Arizonans and Americans “are becoming numb” to the statistics about the historic levels of unlawful immigration activities.

“The border crisis has the potential to negatively impact our country for generations,” he said. “It could alter the trajectory of our Nation. And it’s a tragedy in the clearest sense that it is preventable.”

Which is why the attorney general said it is important for lawmakers, politicians, and law enforcement officials from across the state to “get out of Maricopa County and see what is going on at the border.”

The border crisis is also why Brnovich finds it frustrating that the Biden Administration repeatedly demonstrates the rule of law no longer means anything. That leaves taxpayers to foot the bills.

“It is a fundamental unfairness,” he said, one which Sen. Mark Kelly “could stop tomorrow.”

According to the attorney general, all Kelly has to do to announce to Biden that border security and immigration must be addressed now.

“If Senator Kelly cared at all regarding Arizona, he would not do anything else until the border crisis is addressed,” Brnovich said. “There is nothing more consequential for Arizona. There is nothing more urgent and pressing than stopping this crisis.”