by Terri Jo Neff | Aug 31, 2022 | Economy, News

By Terri Jo Neff |

Foreign trade missions are a tool for key industry and government leaders to develop international business opportunities by meeting face to face. And right now, Gov. Doug Ducey is in Taiwan for one such trip that will include time in the Republic of Korea.

Ducey’s office says his five-day trade mission will “focus on strengthening Arizona’s well-established partnerships with the two Asian partners,” including meetings with Taiwan President Tsai Ing-wen, Taiwan Minister of Foreign Affairs Jaushieh Joseph Wu, and U.S. Ambassador Philip Seth Goldberg.

“Arizona has excellent relationships with Taiwan and the Republic of Korea,” Ducey said in announcing his arrival in Taipei on Tuesday. “The goal of this trade mission is to take these relationships to the next level – to strengthen them, expand them and ensure they remain mutually beneficial.”

Bilateral trade totaled $1.92 billion between Arizona and Taiwan last year along with $882 million between Arizona and the Republic of Korea, commonly known as South Korea. The governor’s itinerary includes delivering the keynote address to a group of American and Taiwanese business leaders as well as meeting with leaders of high-tech manufacturing companies.

“Arizona enjoys strong economic partnerships rooted in sectors such as technology and manufacturing – specifically within the semiconductor industry,” said Ducey, who is accompanied on the trip by Sandra Watson, who is the President and CEO of the Arizona Commerce Authority, as well as Danny Seiden, the President of the Arizona Chamber of Commerce and Industry.

Among those involved in the trade mission are officials with Taiwan Semiconductor Manufacturing Company (TSMC) which plans to train nearly 750 Arizona employees in Taiwan as part of the company’s $12 billion semiconductor facility being built in Arizona. Chip production is expected to begin at the Arizona plant by 2024.

Another itinerary item has the governor celebrating the signing of a Memorandum of Understanding (MOU) between the State of Arizona and the Taiwan Ministry of Education. The MOU is signed by the Arizona Board of Regents and its counterpart in Taiwan for the purpose of promoting collaboration in higher education and workforce training, according to Ducey’s office.

The state budget this year included legislation establishing Arizona’s first foreign trade offices in Taiwan and the Republic of Korea. Those offices are expected to launch later this year.

Ducey’s trip to Asia follows a five-day economic mission to Israel in May which focused on increasing trade and investment between Arizona and Israel, as well as addressing drought issues. It was the governor’s second official visit to the country.

MORE ABOUT GOVERNOR DUCEY’S ISRAEL TRIP

by Corinne Murdock | Aug 10, 2022 | Economy, News

By Corinne Murdock|

Gannett, parent company to the Arizona Republic, will commence layoffs and diminish salaries following a poor second quarter last week.

Gannett, which also owns half of the Arizona Daily Star, said in a press release that this “significant cost reduction program” would help pay down $150 to $200 million of their debt. The media conglomerate reported a net loss of $53.7 million, or over 7 percent of its margin. Gannett also experienced a 7 percent decrease in revenues, despite digital revenues increasing 1.5 percent to make up 35 percent of total revenues.

The Tucson Sentinel said that its sources confirmed that Gannett tasked managers with layoffs. Poynter sources clarified that salary cuts will have a 10 percent minimum, and that layoffs begin on Friday.

These layoffs will come, despite Gannett’s participation in initiatives like the Big Tech-funded program, Report for America, which supplied and covered portions of reporter salaries at 21 of its papers, including the Arizona Republic. The paper has hired three Report for America reporters so far. Report for America received an undisclosed sum of $5,000 to $50,000 from Gannett.

Report for America covers at least half of its reporters’ salaries the first year, a third of their salaries the second year, and just under a quarter of their salaries the third year, with the offer to cover the remainder of these salaries through fundraising.

The Arizona Republic subscriber base has declined over the years. According to their latest Securities and Exchange Commission (SEC) filing, their daily circulation was just over 109,000, with a Sunday circulation of over 320,200. That’s about 1.5 percent and 4 percent of the total Arizona population, respectively, and marks a decline of over 7,000 from 2020.

In 2019, their circulation numbers fell below 100,000, marking the steepest decline among Gannett papers.

The SEC filing reflected that the Arizona Republic is Gannett’s fourth-largest major news publication, with the third-largest daily and Sunday circulations.

USA Today has a daily circulation of nearly 781,200 and a Sunday circulation of nearly 534,600; Detroit Free Press has a daily circulation of over 83,700 and a Sunday circulation of over 896,600; and the Columbus Dispatch has a daily circulation of nearly 137,800 and a Sunday circulation of over 134,700.

Comparatively, the New York Times reported a $76 million profit for their second quarter despite being a smaller company than Gannett.

Gannett’s report inspired new criticisms from its journalists and their unions across the country. The Media Guild of the West indicated that Gannett’s recent decline occurred because the conglomerate was more concerned with corporate lobbying than sustaining newsrooms.

The guild cited Gannett’s network-wide advertising and editorial campaign in support of the Journalism Competition and Protection Act (JCPA) to remove antitrust restrictions preventing Gannett from being paid for content to appear on the platform feeds of social media giants like Google and Facebook.

The guild noted that Gannett authorized its CEO to buy more company stock rather than invest in retaining journalists.

Corinne Murdock is a reporter for AZ Free News. Follow her latest on Twitter, or email tips to corinne@azfreenews.com.

by Terri Jo Neff | Aug 9, 2022 | Economy, News

By Terri Jo Neff |

The Arizona Chamber of Commerce and Industry is hoping the U.S. House of Representatives takes a hard look at H.R. 5376, which was formerly known as the Build Back Better Act until being recently rechristened as the Inflation Reduction Act of 2022.

“Arizona job creators oppose the vast majority of the provisions in this bill,” Chamber CEO Danny Seiden said Sunday after the U.S. Senate passed the legislation on party lines. “This bill will not reduce inflation and it will not make the U.S. economy more competitive. Renaming a massive tax and spending bill the Inflation Reduction Act does not improve it.”

Seiden says Sen. Kyrsten Sinema met with Arizona business stakeholders to hear their concerns and did help blunt some of the more harmful provisions, especially those which impact manufacturing businesses already doubly hit by inflation and supply chain disruptions

He also acknowledged there are a few beneficial elements of H.R. 5376 such as provisions which encourage continued business investment and provide significant drought resiliency funding to promote a water secure future.

But despite some of “positive aspects,” Seiden insists H.R. 5376 leaves much to be desired. Which is why he and other state business leaders are calling on Arizona’s nine Representatives to take a closer look at the bill in advance of an expected Aug. 12 vote.

“With the bill headed to the House, we would encourage the Arizona delegation to consider the legislation’s negative effect on Arizona jobs,” Seiden said, adding that that renaming the unpopular Build Back Better Act does not improve the fact the legislation is a massive tax and spending bill.

The legislation is estimated to raise $740 billion in additional revenue from new taxes as well as more enforcement of existing tax laws. It also authorizes $430 billion in new spending, although a more thorough analysis by the Congressional Budget Office has not been completed.

One thing the CBO already knows, U.S. Senator Bernie Sanders said on the Senate Floor, is that what he labeled the “so-called” Inflation Reduction Act will have “a minimal impact on inflation.”

The CEO of the National Association of Manufacturers also expressed disappointment with H.R. 5376. According to Jay Timmons, the Inflation Reduction Act will stifle manufacturing investment in America, undermining the very businesses which kept America’s economy afloat during the COVID-19 pandemic.

“To be sure, (the bill) was worse before Sen. Sinema worked to protect some areas of manufacturing investment,” Timmons said. “But the final bill is still bad policy and will harm our ability to compete in a global economy.”

Also speaking out against H.R. 5376 is the Pharmaceutical Research and Manufacturers of America, whose members will be directly impacted by Medicare drug price controls included in the legislation.

“They say they’re fighting inflation, but the Biden administration’s own data show that prescription medicines are not fueling inflation,” said PhRMA CEO Stephen Ubl. “And they say the bill won’t harm innovation, but various experts, biotech investors and patient advocates agree that this bill will lead to fewer new cures and treatments for patients battling cancer, Alzheimer’s and other diseases.”

by Corinne Murdock | Aug 8, 2022 | Economy, News

By Corinne Murdock |

Over the weekend, Arizona’s two Democratic senators, Mark Kelly and Kyrsten Sinema, fell in line with their party and backed the Inflation Reduction Act (IRA). The IRA passed the Senate on Sunday along party lines, 51-50, with Vice President Kamala Harris casting the tie-breaking vote.

The IRA, a repackaged version of President Joe Biden’s Build Back Better (BBB) Act, projected well over $700 billion in revenue. However, some analysts have warned that the IRA will have the opposite desired effect on job creation, inflation and deficit reduction, incomes, tax rates, and drug prices.

The two senators opposed amendments to the IRA that would fund $500 million to finish the border wall, approve coal leases, increase domestic oil production in order to lower gas prices, protect those making under $400,000 from additional tax audits, limit price controls for treatments for conditions like cancer and Alzheimer’s disease, require oil and gas lease sales in the outer Continental Shelf, provide discounted insulin for low and middle-income Americans, remove $45 million in climate-related expenditures, retain Title 42, strike a tax increase resulting in higher energy prices for those earning under $400,000, hire more Border Patrol agents, reduce drug prices, invest in violent crime prevention, and prohibit tax credits for electric vehicles built with slave labor.

The IRA will also expand the Internal Revenue Service (IRS) by up to 87,000 more employees through an $80 billion investment. That will make the IRS bigger than the Pentagon, State Department, FBI, and Border Patrol combined, as noted by Washington Free Beacon. IRS data reveals that over half of all IRS audits in 2021 focused on taxpayers making less than $75,000 a year.

All Democrats, including Kelly and Sinema, rejected an amendment to remove provisions expanding the IRS.

Arizonans gathered on Saturday in Phoenix to protest Sinema and Kelly’s support of the bill. FreedomWorks Grassroots Director and Co-founder of EZAZ.org Merissa Hamilton, who helped organize the protest, criticized Sinema and Kelly for supporting the IRS increase, which she called an “inquisition” comparable to the treatment of ideological opponents under the Obama administration.

“Clearly, your IRS inquisitions are to target us like you did the Obama-Biden administration, and we have had enough,” said Hamilton. “We’re already in the middle of a recession — I know it’s tough for you to say the “r” word, but it’s time for you to take responsibility, represent Arizona, and stop betraying us.”

An amendment to prevent oil sales to China was ruled out of order by Senate chair after Kelly and Sinema joined the majority of Democrats to waive it.

Sinema insisted that the IRA would “help Arizonans build better lives” through lowered prices on goods and services, accessible health care, and water and energy security. Sinema promised that the IRA would cause Arizona’s economy to improve.

As AZ Free News reported last week, Sinema’s original holdout on the IRA concerned its carried tax provision. Democratic leadership agreed to drop that provision in order to earn her vote.

Kelly elaborated further on the rationale for the Arizona senators’ votes. He said that the IRA will lower prescription drug costs, implement funding to effectively combat drought and “climate change,” and reduce the deficit. Kelly promised that the IRA wouldn’t result in increased taxes for small businesses and middle-class Arizonans.

“When I meet with Arizonans and small businesses across our state, the top concern I hear about is rising costs,” said Kelly. “This is going to lower costs for health care, prescription drugs, and energy while creating great-paying jobs in Arizona.”

Notable opposition to the IRA came from Senator Bernie Sanders (I-VT). The senator criticized the IRA for not doing enough to help the working class, and proposed amendments to modify the bill that were roundly rejected, 99-1. However, Sanders ultimately fell in line with the Democratic Party and voted for the bill.

Corinne Murdock is a reporter for AZ Free News. Follow her latest on Twitter, or email tips to corinne@azfreenews.com.

by Corinne Murdock | Aug 4, 2022 | Economy, News

By Corinne Murdock |

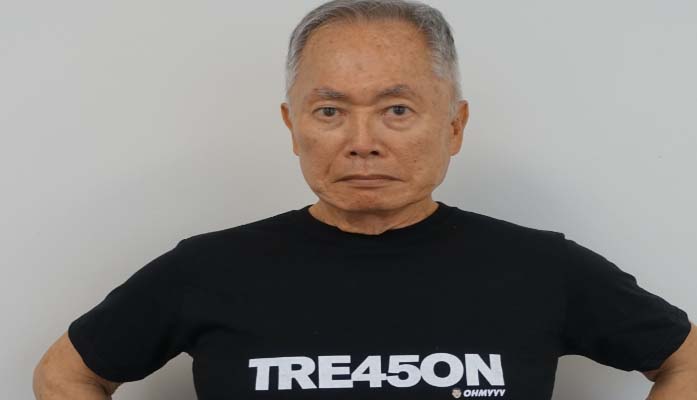

George Takei, of “Star Trek” fame, threatened to remove Senator Kyrsten Sinema (D-AZ) from office if she opposes President Joe Biden’s bill raising corporate taxes.

The legislation in question, the 725-page Inflation Reduction Act (IRA) of 2022, would impose a 15 percent minimum tax on corporations with income of $1 billion or more and closure of a carried interest provision in the tax code. The legislation is a repackaged version of Biden’s Build Back Better (BBB) Act. It gained momentum after earning Senator Joe Manchin’s (D-WV) support last week, who held out previously over concerns that it would exacerbate inflation.

Takei is a New Yorker and prominent LGBTQ+ activist; Sinema’s the Senate’s first bisexual member.

Sinema’s opposition stands in the way of Democrats’ budget reconciliation — the only way Biden can have his bill passed without Republican support.

Costing around $433 billion, the IRA would invest $369 billion into renewable energy and climate change programs, enforce price controls on prescription medication, allow Medicare to negotiate drug prices and caps out-of-pocket cost to $2,000, expand the IRS budget by $124 billion, and extend the Affordable Care Act (ACA) while lowering premiums.

Democratic leadership claimed that the IRA would raise $739 billion in revenues, effectively reducing the deficit by over $300 billion and countering the historic high inflation (9.1 percent) plaguing the nation currently. In the Democrats’ one-page summary of the IRA, they claimed that the IRA wouldn’t result in any new taxes on families making $400,000 or less, and no new taxes on small businesses.

The Tax Foundation estimated that the IRA would eliminate about 30,000 jobs and reduce economic output and after-tax wages in the long run. They identified the 15 percent minimum tax on corporations as the main cause for projected job reduction.

On Tuesday, Sinema spoke with Arizona Chamber of Commerce President and CEO Danny Seiden about the legislation.

Seiden and the Arizona Chamber of Commerce oppose the bill. They insist that the IRA would raise taxes and disincentivize businesses’ growth.

On Wednesday, Axios reported that sources close to Sinema revealed that the senator may support the IRA if it’s expanded to include provisions improving drought and water security in the Southwest. Politico sources close to Sinema put a price tag to that request: $5 billion.

Arizona has been in a long-term drought for nearly 30 years, a status worsened by the recent reclassification of the Colorado River to Tier One drought status. That reduced Arizona’s water allotment, and prompted Governor Doug Ducey to seek out Israeli desalination technology to counter the drought.

Corinne Murdock is a reporter for AZ Free News. Follow her latest on Twitter, or email tips to corinne@azfreenews.com.

by Terri Jo Neff | Jul 25, 2022 | Economy, News

By Terri Jo Neff |

Agriculture has long been a key to Arizona’s economy, as shown by the inclusion of cotton and citrus in the 5 C’s of the state’s top economic drivers (copper, climate, and cattle being the others). But one company in Eloy believes the motto should be amended to include an R, as in roses.

In 1986, the rose was decreed by President Ronald Reagan as America’s national floral emblem. The next year, Michael Francis started Francis Roses on a few acres in Maricopa County.

Today, nearly 75 percent of long-life garden rosebushes are grown in climate-friendly Arizona, with Francis Roses having the largest market share. The company sells its early growth rosebushes to nurseries and other wholesalers through the U.S. and Europe.

Michael’s son Tyler now helms the company and was responsible for relocating the business to Eloy in Pinal County in a careful transition which began in December 2020. Tyler Francis acknowledges that the move to Eloy after so many years in the West Valley was not without its challenges, given the variations in soil, water, and air.

There is also a difference in cultural farming practices and definitely a more rural setting..

“It made us better farmers due to needing to ensure best practices for growing a highly specialize horticulture crop in a new environment,” Francis told AZ Free News.

There are 37,000 types of registered roses worldwide, although many from before the 1970s are no longer commonly available. It is also extremely difficult for new varieties to come to market despite improved breeding efforts, according to Francis.

“Roses are quite hearty but like anything they are susceptible to weaknesses over time,” Francis said. “At Francis Roses, we’ve taken a very long approach to how we introduce a new variety.”

Francis pointed out there is a vast difference between the genetics of garden roses compared to roses grown to be sold as cut roses. Specialty roses like those Francis Roses grows are a big economic engine with a small environmental footprint, with 400 acres of his roses generating the same revenue as 15,000 acres of cotton.

And Francis is cognizant of the challenges agri-businesses face, which is why he takes the position that the other commercial rosebush growers are not competitors. He looks at them instead as potential customers, an attitude he further developed during a recent stint as president of the Arizona Nursey Association.

Francis’ background in economics becomes obvious when he begins to talk about rosebushes, or “units” as he refers to them. He also recognizes the economic impact Francis Roses brings to the Eloy area and the future growth potential.

Which is one reason Francis is deeply committed to the company’s research and development efforts which have led to propriety methods of fertilizers and other products to help maintain moisture in soil. The company has also chosen to work with only the most respected rose breeders in the world.

It can take two years for a Francis Roses rosebush to grow just a few inches, and each will inspected several times before being shipped off to farms and nurseries across the globe. One such facility is co-owned by Francis Roses in Texas where the rosebushes grow bigger before being sold or distributed to retail clients such as Armstrong Garden Centers.

Francis Roses grows about 400 varieties of garden roses at any given time, and evaluates 400 to 600 more varieties for features such as color, disease resistance, and fragrance. It can harvest upward of eight million units annually, but giving life to some of the world’s most prized roses requires a lot of work, and workers.

Some of those workers are fulltime employees with ag-related degrees, while the majority come to Arizona for several months at a time under H2A visas as temporary agricultural workers.

The state’s housing shortage, which is particularly acute in Pinal County, has required Francis Roses to think outside the box to care for those workers. The company recently partnered with Clayton Homes to provide on-site housing, and Francis is looking at other options to make the jobs more appealing to the workers.

“Without those workers we would not exist,” Francis said, adding that the company pays above average ag-business wages. “I am happy Francis Roses is able to provide high paying agriculture jobs in Arizona. The vitality and diversity of the state’s economy is important to me.”

In 2016, Francis Roses released its Miranda Lambert hybrid tea rose. Royalties from sales of the specialty rose are donated to Lambert’s Mutt Nation for ending animal neglect. The company has also recently developed a Julie Andrews tea rose.

FUN FACT: Most cut roses purchased from a florist for Valentine’s Day or Mother’s Day do not come from U.S. rose farms. Instead, they are imported from South America, particularly Ecuador and Columbia.