by Voice of Chandler | Jan 12, 2023 | Opinion

By The Voice of Chandler |

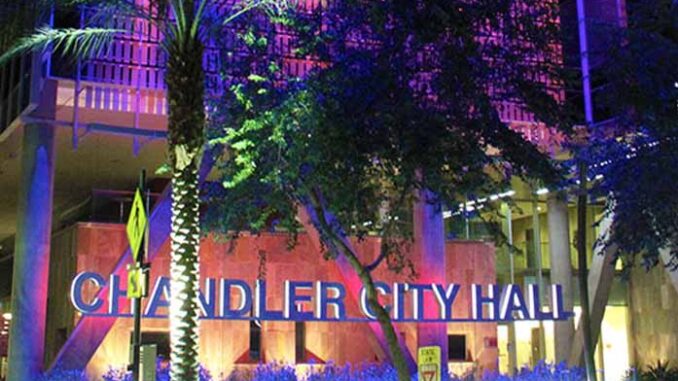

Last month, the City of Chandler unanimously passed Resolution 5656 to reject the proposed ‘Landings on Ocotillo’ high-density housing project. From the start, the developer has been smearing our neighbors for no other reason than we support the plans that have been voted on and approved for our community.

Along with the city, we support additional affordable housing for the community. But the fact is, this isn’t about affordable housing. If it were, then the developer—and their high-paid zoning lawyers, PR firms, and nonprofits—would have found a way to make the project work at one (or more) of the 14 other sites that fit within existing planning.

This is about profit. And to make matter worse, in just 15 years, this housing can (and probably will) convert to regular market rate housing. This means that the subsidies will go away, and the tenants who need the subsidies will get kicked out.

The reality is that the City of Chandler has already approved multiple affordable housing projects in line with the voter-approved City Master Plan. In October, the City of Chandler approved a large public housing development for seniors. In November, the City approved hundreds of affordable housing units in its Downtown District. Resident and neighborhood opposition groups have been unanimous in their support for affordable housing, which can be further evidenced by their 85% affirmative vote on the Chandler General Plan.

The problem is that the high-density housing project (Landings) proposed by the Developer (Dominium) is on an unsuitable county island site. Development as a multifamily living site is incompatible with the voter-approved General Plan, the Chandler Water Master Plan, and the Chandler Airpark Area Plan, as noted by the City Council in Resolution 5656.

Given that Arizona is a desert, the largest issue is the incompatibility with the Chandler Water Master Plan—the site in question does not have the water capacity to support any form of housing. The City allocates water in accordance with the Chandler Water plan depending on intended use and zoning. The site in question is currently zoned for farming with the plan to rezone it to light industry or employment under the Chandler General Plan and Chandler Airpark Plan. Light industrial/employment is allocated 121 gpd per 1,000 ft, whereas the proposed multifamily housing requires over twice that amount at 253 gpd per 1,000 ft. If this project were approved, the site would have grossly insufficient water. Neither Dominium nor its representatives have addressed in the media or to government officials how they will supply the 102 gpd shortfall. With existing drought conditions, Chandler is currently under Tier 2 water shortage restrictions. There is simply not enough water to support this proposed development at this location.

The assumption that this land would be used for light industrial uses has been the basis for other plans like traffic planning. Using this land for housing instead of light industrial would increase the number of cars on the road in an area that already has the highest traffic incidents with a record injury rate when compared to the rest of southern Chandler. The full impact on traffic from current construction projects is yet to be felt in this already congested area, and this unplanned project would only make it worse.

The City of Chandler offered Dominium fourteen other locations for consideration that are in line with existing plans. Dominium refused to consider these other locations. Instead, it is focused on this specific parcel of land. The alternate locations are smaller, but they have the requisite water allocation and would fit within the parameters of the voter-approved Chandler Master Plan.

The everyday residents who live and work in this neighborhood were all universally opposed to the project at the City Council meeting. Those who spoke in favor were from other cities and organizations. Should special interest groups and outside actors determine what is best for a city? Is the voice and concern of the neighbors and residents inferior to that of a deep-pocketed developer with the right political connections?

Enough is enough. Where a voter-approved plan exists, we the people should always have final say—not some multi-million-dollar corporation. And when this case is brought before the Maricopa County Board of Supervisors this year, they must affirm this important principle.

The Voice of Chandler is a group of concerned Chandler residents fighting for the rights of We The People. You can find out more about their work here.

by Charlotte Lawrence | Jan 11, 2023 | Opinion

By Charlotte Lawrence |

During the 2021-22 school year, I’d been hearing about parents finding books and materials on gender identity at their children’s school. I thought that would never happen at my kids’ school. We live in Chandler, part of Chandler Unified School District (CUSD80). Our district ranks an A+, as well as our school, Carlson Elementary. Andy Morgan, the principal, was fairly new in his role, and I had always thought he did a good job.

However, my mommy instinct kicked in, so I decided to have a talk with my son. Eli is 11 years old and watches out for his two younger sisters who are ten and nine. My son is a pretty mature kid and hears everything. I told him at the beginning of the 2022-23 school year to let me know if he sees people using the wrong restroom, if he hears of confusing pronouns, or if he reads anything regarding sex education. I told Eli he needs to be mommy’s eyes and watch over his sisters like he typically does.

In late July 2022 (in school for maybe two weeks), I picked up the kids from school, and my son told me about a book he saw in the library that day. He said the book was on display in the library, and it was called “George.” Eli said, “I picked it up and read the back and saw it was about a boy who wanted to be a girl…. Mom, I think it was like those books you told me about.” He had not checked out the book, so I asked him to the next time at the library. “Check out the book, but don’t read it. Bring it home, and Mommy will let you know,” I told him.

The following Monday, at school pick-up, my son handed me “George,” by Alex Gino. After dinner I read every page, and I couldn’t sleep that night. I was shocked! This book was not only IN a school library, but it was even FEATURED on display! In short, “George” talks about hormonal medication, surgeries, keeping secrets from parents, PORN, and a lot more. I was livid.

The next morning, I emailed Principal Morgan with screenshots of the front and back of the book. His response was that he was out of town for a week but asked if I’d like to speak to the Dean of Students, Bridgett Matson, or wait until he returned. Mr. Morgan did acknowledge this book should not have been in the library. I asked him to please have Mrs. Matson reach out to me. I heard nothing. I waited a week and finally was able to set up a meeting with them both. During that week, the photo I had of the book circulated on social media. I wanted parents to know that this issue is real.

At the meeting, the principal apologized for the book getting into my son’s hands and asked how Eli found the book. He mentioned the backlash he was getting from other parents in the school and community. Mr. Morgan assured me that for years he’d gone through every single book in that library because they were making sure these books weren’t there. I advised him that there are at least 3 more books like this in his library. (A friend of mine gave me a website, gofollett.com, where you can see all the books in school libraries.) The principal bit his tongue. I then asked him, “Doesn’t this book break the sex education and parental consent laws?” He didn’t know.

Then he asked what I wanted to be done about this. I said, “I want this reported to the School District, and for these books to be removed from each elementary library.” To his credit, Mr. Morgan took responsibility and apologized again. But he then added his frustration at getting emails calling him a ‘groomer,’ as if expecting me to apologize.

The following monthly Chandler Unified School Board meeting, I spoke and read straight from the book hoping that the board members would realize the impact of this book on children. I advised the board members that if I were to hand this very book to a child on the street, I would be arrested. The next day I started getting texts from friends letting me know that CUSD80 board member Lindsay Love was posting pictures of me and attacking me on her social media. I wasn’t going to let this go. I went to the district office to complain and was told there wasn’t anything they could do to help me because Lindsay Love is an elected official.

At that moment I finally accepted reality. My public school, which I had always loved, was no longer a safe place for my kids—or our family. Homeschooling was the best option for us, especially with the help of the new ESA program.

I want all parents to know—it’s time to start paying attention, not only to the teachers and classwork, but the principal, the district board members, and the Superintendent of Instruction. When the book came home and was in my son’s hands, I needed to know who to go to. First the principal, then who is above? The district. Once I knew the district wouldn’t help, then who? The Superintendent, who at the time had a ‘Q chat’ space on the Arizona Department of Education’s website. Then where to go? I was told to contact my local legislator. At that time, we had a leftist woke legislator as well. So where do parents turn when no ‘official’ is left?

This is why local elections are critical. We need to pay attention to the people running for these offices. But even before election season, NOW is the time to find good people to run for office. It starts at a local level. As parents, we need to pay attention to everything these days. Read everything your child brings home. Get involved in the class if at all possible. Ask teachers for learning lessons. Find out what curriculum is being used. Most importantly, have open communication with your children.

We parents are the ones in charge of our kids’ education, health, and safety. Maybe our school teachers and administrators will finally accept that fact when enough of us start showing up.

Charlotte Lawrence is a 41-year-old stay-at-home mom with 3 kids. Her ultimate goal is to help bring awareness to parents about what their children are learning and to help protect our children’s innocence.

by Dr. Thomas Patterson | Jan 2, 2023 | Opinion

By Dr. Thomas Patterson |

Decades of institutional self-neglect have left Congress dysfunctional and unfit to fulfill its constitutional role as the most consequential branch of government. Government of the people has morphed into government by bureaucrats, by the executive, and by the courts. The decision-making mechanisms of the People’s House are broken.

If you were fortunate enough to be educated in “civics,” you may remember being told of the process by which a bill becomes law. It is introduced by sponsors, assigned to committees, vetted with testimony and amended, referred to the whole body if approved, debated and amended again, passed out, and then sent to the corresponding legislative body if successful.

Known as Regular Order, the process can be tedious, but it has a purpose: to ensure a free, fair process in a lawmaking body where input from all is accepted and the final vote reflects the informed decision of a majority of members.

Well, kids, here’s the bad news. That process doesn’t really exist in today’s Congress. Instead, lawmakers use their authority to exempt themselves from their own rules. A jerry-rigged-substitute process has developed that, in the House, concentrates power in the Speaker’s office.

Meaningful decisions are made almost always at the leadership level. The rank-and-file are simply suits who vote. Representatives write newsletters telling constituents of any pork they’ve been able to score and the issues they are “fighting for” without disclosing how little real influence they have.

Thus, Congress enfeebles itself. It’s well suited to incumbent protection but not for effectiveness as an institution.

The Freedom Caucus, a right-leaning group of Republicans, is determined to change this. They note, for example, Congress hasn’t produced a legitimate budget in decades. Instead, they pass leadership-created “omnibus” bills with little prioritization or accountability, a process that has contributed to our devastating debt.

The Freedom Caucus has taken a lot of guff for their reform efforts. But how can they be faulted for grasping at a rare chance when they have influence? In the last Congress, they were a minority faction in a minority caucus. Now that their votes are needed to elect Kevin McCarthy to the speakership, they are trying to wield their influence usefully.

Their main ask is that the rank-and-file get a voice in the legislative process. Under present rules, for example, no lawmaker is able to introduce an amendment, either in committee or on the floor, in open process. The hoped for solution is to mandate voting on amendments that are supported by at least 10 percent of the members, a move that would greatly open up the legislative process.

Probably the most controversial proposal is to revive the “Motion to Vacate the Chair,” which empowers any member to call for a new speaker election. The rule was in place for 200 years before it was repealed in 2019 by Queen Nancy.

In practice, the rule was rarely invoked, presumably under the ancient dictum that “if you strike the king, you must kill him.” It would make the speakership less autocratic, balancing the power differential between leadership and the rank-and-file.

Pelosi Democrats often wrote significant legislation behind closed doors and then bull rushed it through Congress before legislators had time to read it. The Freedom Caucus members are calling for 120 hours between a bill’s introduction and its passage, which could only be overridden by a two-thirds majority.

Finally, the Freedom Caucus is asking McCarthy to agree to secure majority support from Republican members before bringing legislation to the floor. This too seems reasonable since Americans will rightly hold Republicans accountable for the performance of the House this term.

None of these proposals are outrageous. In fact, by making the legislative process more democratic and transparent, they give Republicans the chance to present themselves as the party of sound governance.

But the Freedom Caucus should not overplay its hand. If Rep. McCarthy is willing to compromise on some of their key demands, they should honor their own principles of majority rule and concur in his election, since it is favored by an overwhelming majority of Republicans.

Both sides should see this is an opportunity for a win-win, the potential kickoff to a new era of constructive change.

Dr. Thomas Patterson, former Chairman of the Goldwater Institute, is a retired emergency physician. He served as an Arizona State senator for 10 years in the 1990s, and as Majority Leader from 93-96. He is the author of Arizona’s original charter schools bill.

by Ben Beckhart | Dec 27, 2022 | Opinion

By Ben Beckhart |

In January, Arizona’s 55th legislature will convene with new challenges. Republicans managed to maintain slim majorities in both chambers, but what can we possibly accomplish with a Democratic Governor? It will certainly be more difficult to get pro-liberty legislation signed into law, but there are still tangible goals worth fighting for. We just have to be realistic and narrow down our agenda.

The Republican Liberty Caucus of Arizona has published its top five priorities for the 2023 legislative session. These are pragmatic ideas to advance the principles of individual rights, limited government, and free markets, even under a Democratic Governor. Several of these goals were included in Senate President Warren Petersen’s plan to help Arizonans combat rising prices, which we fully support.

The first priority is the same for every legislative session: kill the bad bills. Moderate legislators will be looking for ways to compromise with our new Governor by promoting legislation that will expand the size and scope of government. Our primary focus will be to fight these bills in the legislature, preventing them from reaching the Governor’s desk.

Our second priority is one of Senate President Petersen’s priorities: to repeal the municipal rental taxes on residential properties. These are taxes imposed on residential rental properties by cities and towns. The cost of housing has skyrocketed in recent years, especially in Arizona. As many municipalities sit on massive surpluses, they should be looking for ways to cut taxes and alleviate the cost of housing. Sadly, few cities have done this. It’s time for the legislature to change Arizona statute by revoking the cities’ authority to tax residential rental properties. Rep. Shawnna Bolick ran a bill last session to repeal this tax, and it passed the House with bipartisan support. With support from multiple Democratic lawmakers, this is something Governor Hobbs might sign.

Priority number three is also one of Senate President Petersen’s priorities: eliminate the food tax. One of the reasons why cities are seeing record high revenues is because inflation forces people to spend more. This means more sales tax revenue. Food is a necessity and a tax on food is a regressive tax that especially hurts the middle and lower class who are already struggling with inflation. Some Republicans might object to a repeal of food sales taxes because sales taxes are less invasive than income or property taxes. While we agree a reduction to income or property taxes would be preferable, we should be looking to cut any and all taxes wherever there is a consensus for it. By amending statute to prohibit municipalities from taxing food, we would compel local governments to address the rising cost of living by cutting an unnecessary, regressive tax. We can try to pass this as a normal bill, but if the Governor vetoes it, we could also pass it as a referral that goes to the ballot for the voters to decide, bypassing the Governor’s pen. High inflation has decreased the appetite for taxes, as seen by the rejection of Proposition 310 and many failed bonds and overrides. If placed on the ballot, a repeal of the food tax would likely pass.

Our fourth priority is to prohibit the Governor, or any state agency, from shutting down private businesses under the guise of an emergency declaration. Last session, Governor Ducey signed Sen. Warren Petersen and Rep. Leo Biasiucci’s bill to ban cities and counties from shutting down private businesses. Now we must ensure that the state government cannot impose lockdowns. The Governor would surely veto this bill, but the legislature can instead pass a measure to put this on the ballot in 2024. Once again, this would allow the legislature to go around the Governor. It’s unclear if the voters would pass this measure, but with a leftist Governor, we must do all we can to reign in the powers of the executive branch. We cannot allow our private businesses to be shut down by petty tyrants.

Finally, priority number five is a criminal justice reform that would allow simple drug possession offenses to remain undesignated, allowing the court to designate the offense a misdemeanor upon completion of probation. This is not soft on crime because it would only apply to first-time, victimless drug possession charges, and the offense would still be designated a felony if the individual fails to complete probation. By giving people a chance to avoid a permanent felony, this would be a huge incentive for first-time drug offenders to complete probation and become productive, law-abiding citizens. The end result would be reduced recidivism and less taxpayer spending. This bill was sponsored by Rep. Neal Carter last session, and it passed the House unanimously before getting stuck in the Senate. With new committee chairs and bipartisan support, this reform has a real chance at passing.

This is not an exhaustive list, but these are the top five priorities of the Republican Liberty Caucus of Arizona heading into 2023. This legislative session will look different, but there is always work to be done to advance liberty. We must remain vigilant as we fight to keep Arizona a free and prosperous state!

Ben Beckhart is the Vice-Chair for the Arizona chapter of the Republican Liberty Caucus and the Secretary for the national Republican Liberty Caucus board.

by AZ Free Enterprise Club | Dec 24, 2022 | Opinion

By the Arizona Free Enterprise Club |

Arizona taxpayers are tired. It’s bad enough that our state has been getting crushed by the highest inflation rate in the country, but during this past November’s election, the government tried to swoop in and take more of your hard-earned dollars out of your wallet. This time, Arizona voters said enough is enough. Not only did they reject several tax increases, but they ensured victory for one key protection against future tax increases.

Arizonans Reject Prop 310

Prop 310 aimed to increase the statewide sales tax by 0.1% to fund fire districts throughout Arizona, and its proponents used the oldest trick in the book. Just like we’ve seen with past education or transportation tax increases, they tried to convince voters that Prop 310 would only cost them a penny when they buy coffee or a dime when they buy dinner.

But Arizona voters saw through it…

>>> CONTINUE READING >>>

by Dr. Thomas Patterson | Dec 23, 2022 | Opinion

By Dr. Thomas Patterson |

The last time Republicans lived up to their reputation for sound fiscal policy was almost 30 years ago. In March 1995, Speaker Newt Gingrich and the Republican House caucus, to the jeers of skeptics, resolved to balance the federal budget within seven years. They did it in four.

Yet ever since, Republicans have provided slight protection against the unending torrent of Democrat spending schemes. They talk a brave game of cutting when out of power but are mostly unable to curb their political urge to spend when they have the authority.

Consequently, the national debt doubled from $5 trillion to $10 trillion under the inattentive George W. Bush. Candidate Donald Trump in 2016 promised to pay down the debt completely over eight years. Sure. In just four years, the debt surged by $7.8 trillion, a 36% hike.

We’ve all seen the drill. Create an emergency spending need where none exists (climate change) or which could better be addressed in a more measured way (COVID), exaggerate the danger, create panic, open the spigot, take credit.

$4.1 trillion in new spending during the Biden years for these created “emergencies” have put Americans in extremely dangerous fiscal territory. The voters this time gave House Republicans one more chance to redeem themselves. Now the stakes are higher than ever, and the pressure is on.

The early rhetoric was promising. However, vows to “curb wasteful government spending” were followed by…reinstatement of earmarks. Those little pieces of unvetted local pork slipped into spending bills to benefit individual legislators. What a crushing disappointment.

Republicans swore off earmarks in 2011. But when a Democrat Congress brought them back in 2021, 120 Republicans partook, scooping up $5 billion for their own Bridges to Nowhere. A motion this year to disallow earmarks was overwhelmingly defeated in the Republican caucus.

15 conservative policy groups cautioned Republicans that “earmarks are one of the most corrupt, inequitable and wasteful practices in the history of Congress.” Each congressman earns his little cookie by supporting all of his colleagues’ polite graft.

Yet GOP appropriators claimed earmarks were their “constitutional duty” and actually help to control spending! What a crock.

The Republican face plant over a matter so obviously wrong gives fiscal conservatives the sinking feeling that they may not be up to the fight. Candidates barely mentioned the deficit/debt during the last election, in contrast to previous campaigns. What fiscal crisis?

Instead, Americans have been conditioned by their politicians to believe that no wants should be unmet, that we “deserve” lavish government benefits unyoked to effort, that thorny political issues from illegal immigration to educational failure can be solved by simply spending more, and that any fiscal consequences can be safely kicked down the road.

Republicans aren’t going to dig out of this hole any time soon. But they can start the process by doing the right thing right now.

As this is written, Republicans are negotiating an omnibus budget bill of nearly $2 trillion. The leadership has known for nine months this must be completed by year’s end, but once again thoughtful, thorough budgeting has given way to a 4,155-page bill delivered at 1:30 AM to legislators who can’t possibly understand its provisions.

The bill contains no program cuts, but instead a mix of mandatory spending, outrageous pork like LGBTQ “Pride Centers,” and a specific prohibition against funding for border security. Lawmakers must approve the bill now or, in the case of Republicans, be held liable for the dreaded government shutdown.

But economist Steve Moore has a better idea. Republicans only need to refuse to waive provisions of the 2010 Pay-As-You-Go Act. PAYGO has been routinely suspended in recent years, but just 41 of 50 senators refusing this time would result in $130 billion in mandatory “sequester” cuts, just 5% of the Biden spending splurge.

Alternately, Congress could cancel the $80 billion for 87,000 new IRS agents, take back $500 billion in unspent COVID funding, and/or scale back the “Green New Deal” subsidies, a relatively painless way to uphold the PAYGO rules.

Congressional Republicans will never have a better opportunity to begin the return to responsible governance. If they don’t have the will now, when will they?

Dr. Thomas Patterson, former Chairman of the Goldwater Institute, is a retired emergency physician. He served as an Arizona State senator for 10 years in the 1990s, and as Majority Leader from 93-96. He is the author of Arizona’s original charter schools bill.