by Matthew Holloway | Jul 26, 2025 | Education, News

By Matthew Holloway |

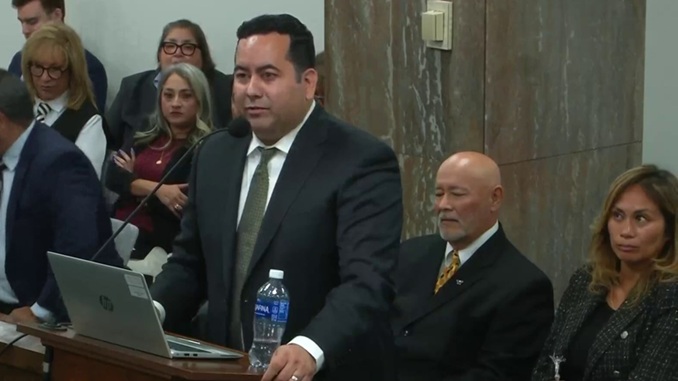

Tolleson Union High School District Superintendent Jeremy Calles found himself the subject of intense grilling at the hands of Joint Legislative Audit Committee (JLAC) Co-Chairmen Matt Gress and Mark Finchem during a three-hour hearing this week. Following the exchange, Gress told reporters that he and Finchem “will be reviewing our options with the Auditor General.”

The fiery hearing came about in response to concerns over a Tolleson Union High School District (TUHSD) leaseback deal with the Isaac Elementary School District that would see TUHSD purchase Isaac Middle School for $25 million with the elementary district then leasing the building at an interest rate of 6%.

Calles revealed in the hearing that he holds two professional roles, one as a consultant and the second as Superintendent, and he confirmed to the committee that initial conversations on the deal began in his role as a consultant.

He told the JLAC, “The first conversation I had came from a text message from, yes, the prior superintendent, Mr. Mario Ventura, who texted me and asked if I could take a look at his finances.”

Calles explained that when his district became involved, his role in the deal changed, although he claimed to have never billed for the conversation and never contracted with Isaac Elementary School District as a consultation client.

“This is not a new concept; the only thing novel on this idea is that both sides of the transaction, you have a school district. Everything else about this transaction, both sides of the transaction are not unseen,” he told lawmakers.

The Superintendent said that the agreement between the districts lacked a prepayment penalty, had no lock-in requirement, and aided the district in a financial crisis. He suggested that the benefit for TUHSD students was in generating up to $7 million in funding for the district. However, committee members balked at this suggestion, noting that although the district holds a “B” letter grade from the Arizona State Board of Education, only 30% of its students are proficient in Mathematics, English, and Language Arts.

Gress challenged him, “Here, you have not been able to demonstrate the $25 million financial transaction benefiting Tolleson Union students directly, given that you have no square footage, you’re not providing any learning services. It’s not even in your district so this is far beyond novel. I think you’ve made a mockery of our state law.”

He added, “I think you should be ashamed of yourself for the way you’ve mistreated taxpayers of Tolleson Union.”

The Superintendent was later asked by Rep. Carbone, “Why doesn’t every school district now just follow your lead and start making money and become a bank?”

In a reponse that appeared to show defiance, he said, “I don’t think every school district has a superintendent willing to stand in front of you like this.”

As reported by State 48 News, Calles confirmed that he utilizes his district office to conduct personal business during working hours. The outlet noted that under questioning it was further revealed that two members of the school district are also employed by the Superintendent through his consultancy.

When pressed to answer questions from Tolleson City Manager Reyes Medrano Jr., along with Police Chief Rudy Mendoza and former Superintendent Kino Flores regarding his conduct, including an alleged request for Tolleson to pay Calles’ real estate broker an $85,000 fee related to the district’s purchase of city land, Medrano suggested this violated state procurement laws.

“The 85 was going to be on top of the purchase price, and then we were supposed to pay the broker with it,” he told the committee. According to Medrano, Calles told him “it would be cleaner” to do so.

Calles lashed out in response, claiming the allegation “borderlines defamation.” He said in full: “I believe that borderlines defamation, the way he made that implication as if something nefarious was happening.”

Speaking with a reporter, Calles rejected the allegations saying that “they’re all lies. Do you see our improvement on the letter grade system? You see that our schools are moving up on their performance?”

The Superintendent told 12News that he expected the committee to request review of his conduct by the Arizona Auditor General and said, “When the Auditor General’s Office finally sends me someone, I’ll give them the full story.”

In a statement following the hearing, Gress said, “The hearing today revealed deeply troubling information that shows a pattern of disregard for public transparency. Combining public service with private consulting work, including using Tolleson District facilities and employees to support superintendent Calles’s consulting company reeks of corruption. Chairman Finchem and I will be reviewing our options with the auditor general.”

Matthew Holloway is a senior reporter for AZ Free News. Follow him on X for his latest stories, or email tips to Matthew@azfreenews.com.

by Matthew Holloway | Jul 26, 2025 | News

By Matthew Holloway |

Congressman Andy Biggs’ gubernatorial campaign reported significant gains in fundraising during the second quarter of 2025 with a haul of $429,000. It marks the single largest fundraising quarter for Biggs in his career thus far.

The campaign reported that Biggs’ fundraising performance improved by almost $200,000 over the first quarter and noted, “This shows momentum and enthusiasm for his campaign with additional room for growth as his digital fundraising operation begins to build out.”

In a statement to AZ Free News, Biggs’ Campaign Senior Advisor Drew Sexton said, “We’re very pleased with our past quarter as Congressman Biggs more than doubled his cash on hand, received endorsements from President Donald J. Trump and Charlie Kirk, and continues his strong performance in every public poll with the set field of GOP candidates. We look forward to building on this in the coming months as the Congressman shares his vision for Arizona with voters from across the state.”

According to Capitol Media Services, Biggs’ primary opponent, Karrin Taylor Robson, narrowly outperformed Biggs in fundraising with $575,000 in individual donations and $2,500 from PACs in the second quarter. However, Robson also reported loaning her campaign over $2.2 million, which has been all but spent on advertising President Donald Trump’s endorsement of Robson.

The Biggs campaign made note of this in an email to AZ Free News stating, “The Biggs for Arizona campaign has an end of Q2 COH of $437K, more than doubling the campaign’s Q1 COH indicating a sustainable level of spending in comparison to the over $2.7M already spent by his primary opponent.”

According to Axios, the state of play as of this report is that:

- Democrat incumbent Governor Katie Hobbs, running effectively unopposed in her primary, has raised the most funds in the second quarter of 2025, netting approximately $1.3 million and held about $4.7 million cash on hand.

- Robson brought in $2.8 million, but as noted, $2.2 million was her own money. She has less than $900,000 remaining and is spending rapidly.

- Biggs however raised $429,000 and closed the quarter with about $437,000 on hand, showing consistent, steady growth.

As reported by AZ Free News in early June, Biggs’ advertising spend has been supplemented what Turning Point PAC declared “the largest launch event in Arizona gubernatorial primary history,” complete with a media campaign costing over $500,000, with the “Biggs for Governor” Rally hosted by Turning Point Action and Turning Point PAC itself counting for “an additional $780,000 in earned media value (EMV),” according to a press release.

Turning Point PAC said in a statement at the time, “Taken as a whole with Turning Point PAC’s $500,000 media buy announcement, the organization’s independent expenditures and organizing to support Biggs’s primary launch already amounts to over $1,400,000.”

Matthew Holloway is a senior reporter for AZ Free News. Follow him on X for his latest stories, or email tips to Matthew@azfreenews.com.

by Jonathan Eberle | Jul 25, 2025 | News

By Jonathan Eberle |

The Republican Party of Arizona, led by Chairwoman Gina Swoboda, has filed an amicus brief in federal court defending the requirement for proof of citizenship in voter registration. The brief, submitted alongside the Restoring Integrity and Trust in Elections PAC (RITE PAC), aims to bolster efforts to preserve what party leaders describe as “the integrity of American elections.”

The filing was made in the U.S. District Court for the Western District of Washington, where legal challenges have arisen over whether federal voter registration forms can mandate documentary proof of citizenship.

Citing the National Voter Registration Act (NVRA), the Arizona GOP and its allies argue that the Election Assistance Commission (EAC) has the legal authority to require applicants to provide citizenship documentation. The brief claims this interpretation aligns with Arizona’s longstanding election laws, which include similar provisions at the state level.

“Protecting election integrity is essential to preserving trust in our democratic process,” said Swoboda in a statement. “Arizona Republicans have long advocated for sensible measures that ensure accuracy in voter registration and protect our elections from fraud. This brief underscores our continued commitment to transparent, fair, and secure elections.”

The brief also defends a Trump-era executive order that directed public assistance agencies to ask applicants about their citizenship status before offering a voter registration form. According to the filing, this directive is not only legal but necessary to uphold the original intent of Congress in limiting voter registration to U.S. citizens.

Supporters of the measure argue that such rules are a common-sense way to protect elections from outside interference or administrative error. While the court has not yet ruled on the underlying case, the Arizona GOP’s legal intervention signals a broader Republican strategy to champion election security measures heading into the 2026 midterms.

The Republican Party of Arizona has remained vocal in national conversations around election reform, frequently advocating for voter ID laws, voter roll maintenance, and what they consider safeguards against fraud. With this latest legal move, the party is reaffirming its position at the forefront of what it views as a critical issue.

Jonathan Eberle is a reporter for AZ Free News. You can send him news tips using this link.

by Ethan Faverino | Jul 25, 2025 | Economy, News

By Ethan Faverino |

New research has shown the best cities in the United States for bargain shopping, with Mesa and Glendale, Arizona, both securing spots in the top 10.

Ranking seventh and fifth, these Arizona cities stand out as prime destinations for savvy shoppers seeking affordable deals, joining other top cities like New Orleans, Louisiana, and Orlando, Florida, in a nationwide ranking of budget-friendly shopping hubs.

The study, conducted by saving experts at BravoDeal.com, analyzed cities with populations over 200,000, evaluating the prevalence of affordable retail options such as vintage and thrift stores, pawn shops, discount stores, flea markets, used car dealerships, outlet stores, and wholesale stores.

Each city was assigned an index score out of 100 based on the number of these stores per 100,000 residents, revealing the best location for cost-conscious consumers.

Mesa, Arizona, earned its seventh place ranking with an index score of 60.28 out of 100. The city has the third-highest number of vintage and thrift stores nationwide, with 35.96 per 100,000 people, making it a hotspot for unique, second-hand finds.

Additionally, Mesa ranks fourth in pawn shops, with 8.01 per 100,000 residents.

Glendale, Arizona, claimed the fifth spot with an index score of 60.68 out of 100. The city leads the nation in pawn shops with 11.03 per 100,000 people, and ranks fourth for outlet stores, with 7.88 per 100,000 residents.

Glendale also secured the seventh spot for discount stores, with 27.97 per 100,000 people.

CEO and Co-Founder of Bravo Savings Network, Marco Farnararo, said, “The ranking is dominated by Southern states, taking up seven of the top 10 spots, and the remainder being occupied by states in the West. This could imply that there is a culture of budgeting and saving money in these regions more than in areas such as the Midwest or the Northeast.”

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.

by Lisa Everett | Jul 24, 2025 | Opinion

By Lisa Everett |

On Wednesday, July 16th, I attended the quarterly public meeting held by the federal monitor overseeing the Maricopa County Sheriff’s Office, alongside Sheriff Jerry Sheridan. These meetings are intended to gather community input regarding the continued federal oversight. Historically, these sessions have been dominated by voices calling for the oversight to continue — but not anymore.

The people of Maricopa County are fed up. We’re tired of the federal government wasting taxpayer dollars, constantly shifting the goalposts, and interfering with our local law enforcement. Last week, hundreds of concerned citizens showed up to support Sheriff Sheridan and his dedicated team. And we’re not done. We will continue to make our voices heard every quarter until Judge Snow hears us loud and clear: enough is enough.

Out of thirteen mandated benchmarks from Judge Snow, the Sheriff’s Office has met twelve. The only remaining issue? Hispanic individuals, on average, experience encounters that are 17 seconds longer than individuals of other races. Seventeen seconds. That is the justification being used to prolong this multimillion-dollar oversight?

As someone who has worked in customer service, I can tell you that when a language barrier is involved, conversations naturally take longer. It’s not discrimination — it’s respect. It’s a commitment to ensuring clarity, understanding, and fairness. I would often take several minutes longer, not just seconds, to ensure someone understood important documents or procedures. That’s called good service — not racism.

Yet the ACLU and federal monitors insist this slight timing difference is grounds for continued federal control. They are actively seeking racism in places where it does not exist, undermining the professionalism and integrity of our Sheriff’s Office.

It’s time to end this charade. The citizens of Maricopa County demand the immediate termination of this federal monitoring. Let our sheriff do his job without unnecessary interference and outrageous costs.

Stop the federal monitoring of our Maricopa County Sheriff’s Office.

Lisa Everett serves as the Legislative District 29 Chair. You can follow her on X here.