by Staff Reporter | Sep 17, 2025 | News

By Staff Reporter |

Requests to establish Turning Point USA (TPUSA) chapters exploded in the days following the assassination of its CEO and founder, Charlie Kirk.

Kirk, a devout, professed Christian and Phoenix native, was a month shy of turning 32 years old at the time of his death. Kirk left behind a wife — CEO of Proclaim Streetwear and Bible in 365, and former Miss Arizona USA, Erika Kirk (née Frantzve) — and two young children.

Andrew Kolvet, executive producer for “The Charlie Kirk Show,” said on Sunday that TPUSA received over 37,000 requests for new chapters.

Prior to Kirk’s assassination, TPUSA reported having approximately 900 college chapters and 1,200 high school chapters, or about 3,500 chapters total.

“The organization has received over 32,000 inquiries in the last 48-hours to start new campus chapters,” said Kolvet. “Charlie’s vision to have a Club America chapter (our high school brand) in every high school in America (around 23,000) will come true much much faster than he could have ever possibly imagined.”

Kolvet also reported to Fox News that he personally received “hundreds of offers” to work or volunteer for TPUSA.

Many have reported witnessing a massive increase in church attendance the Sunday following Kirk’s assassination, accompanied with online postings of baptisms directly influenced by Kirk.

Donations also poured in to support Kirk’s widow and two children.

One GiveSendGo for the Kirk family sits at over $4.9 million as of Monday, with a goal of $6 million. ALP Pouches, a nicotine pouch company, organized the fundraiser.

Another GiveSendGo organized by TPUSA has raised over $1.8 million. TPUSA is also soliciting donations to continue its work and grow.

Another GiveSendGo was launched by conservative pundit Glenn Beck as a resurrection of the 912 Project. That fundraiser has raised over $500,000.

Several smaller fundraisers have also cropped up online and collected thousands: over 200 on GoFundMe as of Monday. The fundraisers pledge money to the Kirk family, TPUSA, or creating memorials.

Kirk was shot and killed on Sept. 10 at Utah Valley University during another one of his viral campus debates, part of his “American Comeback Tour.”

Several days following Kirk’s death, law enforcement arrested Tyler Robinson, 22, for the assassination.

Per the FBI, Robinson had an “obsession” with Kirk and “hated” the conservative evangelist. FBI Director Kash Patel said that Robinson told another individual ahead of the assassination via text that he had an opportunity to kill Kirk and would do so because of Kirk’s Christianity.

“He had a text message exchange with another individual in which he claimed that he had an opportunity to take out Charlie Kirk — and he was going to do it because of his hatred for what Charlie stood for,” said Patel.

FBI Deputy Director Dan Bongino told Fox News that it was “fairly obvious to everyone” that Kirk’s assassination was “an ideologically motivated attack.”

In addition to the messaging evidence, ammunition recovered at the assassination site indicated allegiances to transgender and anti-fascist ideologies. Robinson’s romantic partner, his roommate, was an individual who identified as a “furry” and a transgender woman.

AZ Free News is your #1 source for Arizona news and politics. You can send us news tips using this link.

by Matthew Holloway | Sep 17, 2025 | News

By Matthew Holloway |

Arizona House Ethics Chair Lupe Diaz (R-LD19) blasted Democrats Friday for “weaponizing” complaints against Rep. John Gillette (R-LD30). Democrat Reps. Oscar De Los Santos, Nancy Gutierrez, Quanta Crews, and Stacey Travers filed a complaint on September 10, citing an interview from Gillette and social media posts. They called his remarks “offensive” and “unbecoming of an elected official,” noting his criticism of radical Islamists and Sharia law.

In a string of posts to X referred to in the Democrats’ complaint, Rep. Gillette wrote, “Islamophobia is a construct of the Marxist left I reject. I hear them state that they stand with Hamas and Iran, they want to bring Sharia Law to the US. They chant death to US. I have years of direct experience with these savages. [Their] own religion preached convert or die. F**K EM. If they want here to become the s**t hole they left… they can go home. The democrats support them. DEMOCRATS HATE AMERICA!”

Responding to subsequent comments, he clarified his position, stating, “I was critical of their policies. “Shiria(sic) Law and convert or die” are policy positions of Islam. Democrats want to install Socialism as a policy. I criticize both as they are repugnant to the Constitution. My reply is based on experience in the Middle East and Soviet Union. Not some leftist theory cooked up in a liberal college classroom with the same professors and systems that say there are 32 genders.. grow up and see reality…. remember Covid when you were told to wear a face covering, not work. The left forced this on us, not people like me.”

In their complaint, the Democrat lawmakers claimed, “Rep. Gillette referred to Muslims as ‘f***ing savages’ who don’t properly ‘assimilate’ into American culture. By referring to Muslims as ‘savages’ and ‘terrorists,’ Rep. Gillette dehumanized them and demonstrates his bigotry against an entire religious group, which constitutes about 1% of the population in this state.”

In a letter responding to the Democrat representatives, Chairman Diaz wrote that “remarks, statements, or opinions by a member, alone, are not traditionally the subject of an ethics inquiry. Subject to our House Rules regarding debate, members—like any other citizen—have a First Amendment right to the freedom of speech, as well as a right to freely speak under Article 2, Section 6 of the Arizona Constitution.”

Citing the assassination of Charlie Kirk, Diaz added, “Moreover, particularly in light of recent events, it is imperative that government institutions protect the freedom of speech, rather than take actions to silence, punish, or censor speech simply because someone might find it offensive or disagreeable. The inquiry you request this Committee to make would result in no more than an inquiry into the sincerity of Representative Gillette’s beliefs or a debate into the merits of those beliefs— neither for which an Ethics Committee hearing is the proper venue.”

Diaz concluded, “It would be inconsistent with constitutional principles—and unprecedented, based on past practices of previous House Ethics Committee Chairmen presented with similar complaints to undertake any further review or investigation of your complaint. Accordingly, I will not take further action on this matter.”

He further added an admonishment to the Democratic representatives, urging them to review Rep. Gillette’s response to their press release announcing the complaint, entitled “Defending America Against Radical Ideologies and Political Hypocrisy,” and added, “To the extent that you have any lingering concerns about his statements, it would be prudent to engage in civil discourse rather than weaponizing the House Ethics Complaint process.”

In the statement, Gillette explained in part, “Immigrants are welcomed here as guests who can become fellow citizens, and gratitude, respect, and loyalty to our nation are the minimum expectations. Yet too often, what we see instead is a demand that Americans change our culture, our speech, or our religion so as not to ‘offend’ those who chose to come here. That is not assimilation—it is subversion. I will treat every human being with dignity and respect. But I will not, and Americans must not bow to the demands of those who place their foreign ideologies above our Constitution.”

Gillette defined the group he opposes as “radical Islamists,” who seek “the establishment of a worldwide caliphate,” adding, “While some [in] the Muslim world may practice their faith peacefully, many more have weaponized the concept of jihad to justify terrorism, mass murder, and political conquest.”

Matthew Holloway is a senior reporter for AZ Free News. Follow him on X for his latest stories, or email tips to Matthew@azfreenews.com.

by Jonathan Eberle | Sep 17, 2025 | Economy, News

By Jonathan Eberle |

Arizona residents could collectively lose millions of dollars to fake gambling websites this fall, according to a new study analyzing Federal Trade Commission (FTC) scam reports. The report, conducted by online gaming marketplace Chicks Gold, found that Arizona consumers reported $7.9 million in losses between April and June of this year from scams linked to fake gambling and gaming sites. Analysts warn those numbers could rise sharply as the NFL season, the most bet-on sport in the United States, fuels a wave of online wagering.

“Scammers know there’s likely to be a surge in inexperienced bettors searching online for wagering platforms,” said Al Alof, CEO of Chicks Gold and spokesperson for the study. “That makes them especially vulnerable to fake sportsbooks or offers that appear too good to be true.”

The study examined scams across five FTC subcategories connected to fraudulent gambling platforms: malware and exploits, online shopping, tech support, social networking, and prizes, sweepstakes, and lotteries. Nationally, 106,531 reports were filed in Q2, totaling nearly $192 million in losses, or an average of $1,965 per report. Arizona’s losses were significantly higher: 2,830 reports led to nearly $7.95 million stolen, averaging $2,811 per report—43% higher than the national average.

The most damaging category for Arizona residents was prizes, sweepstakes, and lotteries, which accounted for $4.1 million lost across just 408 reports, averaging more than $10,000 per incident. That placed Arizona sixth in the nation for per-report losses linked to these types of scams, behind Montana, Maine, South Dakota, Wyoming, and North Dakota.

According to the study, fraudulent gambling and gaming operations exploit consumers in several ways:

- Malware and exploits: Fake casino sites that prompt users to download spyware disguised as “mods” or “cheat tools.”

- Online shopping scams: Fake sites selling in-game items, currency, or memberships that never arrive.

- Tech support fraud: Pop-ups or sham help desks convincing players to share sensitive information.

- Social networking scams: Fake or hijacked profiles distributing phishing links in gaming communities.

- Prizes, sweepstakes, and lotteries: Lures promising jackpots or loot boxes that require upfront payment or personal data.

“These scams thrive on community and urgency,” Alof said. “Gamers searching for new releases or fans eager to place bets can be tricked into handing over money or sensitive information.” The rise in gambling scams has also been noted by the Better Business Bureau (BBB), which reports that complaints about online gambling platforms more than doubled since 2023. Users described problems ranging from malfunctioning slot games and altered wagers to deceptive ads and phishing attempts.

To protect themselves, Alof urged consumers to:

- Verify licensing and URLs: Legitimate sportsbooks are licensed by state regulators. Misspelled domains or unofficial app stores are red flags.

- Avoid unrealistic offers: “Guaranteed wins” or oversized bonuses are often bait for scams.

- Use secure payments: Credit cards or PayPal provide better protection than wire transfers or gift cards. Enabling two-factor authentication also reduces risk.

Analysts caution that both sports bettors and traditional gamers face exposure. Beyond the NFL betting surge, Alof noted that the release of popular video games creates another avenue for fraud. When legitimate gaming sites crash under demand, players may turn to unverified download links, which scammers exploit. With Arizona already posting losses above the national average, experts warn vigilance will be crucial in the months ahead.

Jonathan Eberle is a reporter for AZ Free News. You can send him news tips using this link.

by Matthew Holloway | Sep 16, 2025 | News

By Matthew Holloway |

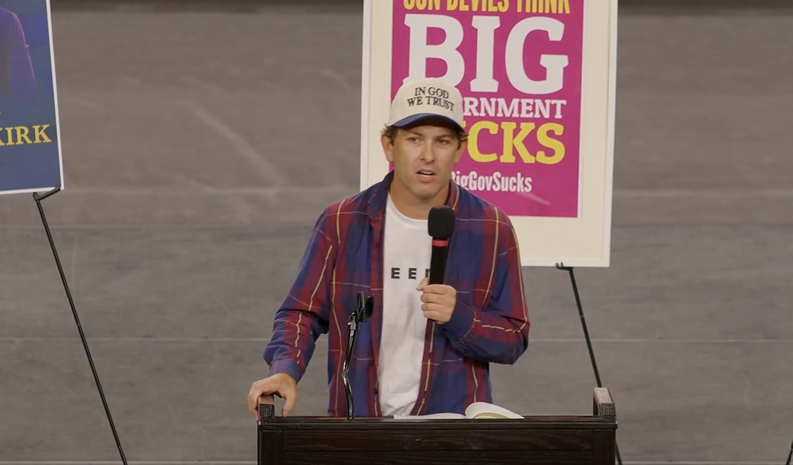

Turning Point USA held a vigil for Charlie Kirk at the Desert Financial Arena at Arizona State University on Monday. Thousands of people, young and old, showed up to honor the life of Kirk.

According to an email from Turning Point USA’s ASU Chapter, the vigil to remember Kirk, who was assassinated on Wednesday, was held under high security conditions with a ‘clear bag’ policy in effect and a prohibition on any banners, flags, and signs of any shape or size in the arena.

Initially, student attendance was prioritized on Sunday, September 14th, with general attendees asked to join a waiting list; however, by Sunday evening, the restriction was removed, and all attendees were invited to RSVP.

Tyler Bowyer, COO of Turning Point Action, wrote in a post to X, “Please join us tonight to celebrate his life and pray. We have a long week ahead of us and the entire Turning Point ecosystem feels your love and prayers. The students in particular deserve to feel it, especially in such a memorable place for us. ASU!”

In an email, Dr. Owen Anderson, faculty advisor of the chapter wrote:

“I hope you can join us tonight. To understand what Charlie Kirk was doing, you have to remember his context.

Charlie was debating edgy university students who often used profane language and hurled insults at conservatives and Christians. He wasn’t playing cards at a retirement home.

In a setting where anti-Christian professors were never challenged, and where many Christian intellectuals felt pressured to compromise with leftism and remain silent, Charlie Kirk changed all of that.

Suddenly, conservative and Christian students felt they could speak up and defend their beliefs. They saw how wrong it was to pay tuition for ideological training camps. Charlie inspired them to have courage. And being courageous is loving because it presents the truth to students who are captive to unbelief.”

Matthew Holloway is a senior reporter for AZ Free News. Follow him on X for his latest stories, or email tips to Matthew@azfreenews.com.

by Ethan Faverino | Sep 16, 2025 | Education, News

By Ethan Faverino |

The U.S. Department of Education released the 2024 National Assessment of Educational Progress (NAEP) results, known as the Nation’s Report Card, revealing historic lows in academic performance for eighth and twelfth-grade students in science, mathematics, and reading.

The data highlights persistent post-pandemic challenges and a widening achievement gap, prompting U.S. Secretary of Education Linda McMahon to call for a transformative shift in education policy.

“Today’s NAEP results confirm a devastating trend,” said Secretary McMahon in a statement released by the U.S. Department of Education. “American students are testing at historic lows across all of K-12. At a critical juncture when students are about to graduate and enter the workforce, military, or higher education, nearly half of America’s high school seniors are testing at below basic levels in math and reading. Despite spending billions annually on numerous K-12 programs, the achievement gap is widening, and more high school seniors are performing below the basic benchmark in math and reading than ever before.”

The 2024 NAEP results show significant declines in average scores compared to 2019:

- 8th Grade Science: The average score for eighth graders dropped for the first time since 2009, with 38% performing below the NAEP Basic level, a five-point increase from 2019. Only 31% scored at or above the Proficient level, down four points from 2019.

- 12th Grade Mathematics: The average score hit its lowest point since 2005, with 45% of twelfth graders scoring below Basic, a five-point increase from 2019. Only 22% achieved Proficient or above, which is down two points.

- 12th Grade Reading: The average score fell below all previous assessments since 1992, with 32% of twelfth graders below Basic, up two points from 2019, and 35% at or above Proficient, down two points again.

According to the National Center for Education Statistics, in the 2020-2021 school year, the United States (between local, state, and federal governments) spent $18,614 per student enrolled. This totals $927 billion in expenditures between public elementary and secondary schools.

Secretary McMahon added, “The lesson is clear. Success isn’t about how much money we spend, but who controls the money and where that money is invested. That’s why President Trump and I are committed to returning control of education to the states so they can innovate and meet each school and student’s unique needs.”

The data highlights a growing achievement gap, with lower-performing students at the 10th and 25th percentiles showing significant declines, while scores for the highest performers remained stable.

The report also reveals a rise in absenteeism, with 31% of twelfth graders missing three or more school days in the past month, up 26% from 2019. Additionally, only 33% of twelfth graders were deemed academically prepared for college in mathematics and 35% in reading, down from 37% in both subjects in 2019.

The NAEP assessments, conducted from January to March 2024, involved approximately 23,000 eighth graders in science and 43,600 twelfth graders in mathematics and reading. The results provide a snapshot of student performance across public and private schools.

Secretary McMahon emphasized the need for action across the U.S., saying, “If America is going to remain globally competitive, students must be able to read proficiently, think critically, and graduate equipped to solve complex problems. We owe it to them to do better.”

Ethan Faverino is a reporter for AZ Free News. You can send him news tips using this link.