By Daniel Stefanski |

Another Republican-led proposal to stimulate and incentivize business development in Arizona is moving through the legislature – though it is unsurprisingly meeting serious resistance from the other side of the aisle.

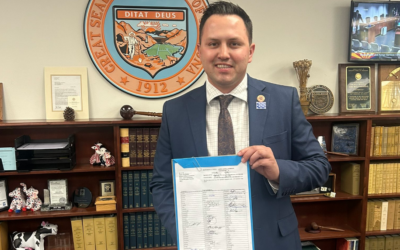

Senator Steve Kaiser sponsored SB 1559, which deals with a reduction in the income tax and fees for new businesses across the state. According to the purpose of the legislation provided by the State Senate, the bill “prescribes a threshold of five percent of state contracts the Arizona Department of Administration (ADOA) is encouraged to award to new businesses each year and exempts a new business and a person who is establishing a new business from filing fees to establish the new business.” It also “establishes an individual and corporate income tax subtraction in prescribed amounts for a new business’s first three years of operation.”

The prescribed amounts for individuals (income received from the new business) and corporations (Arizona gross income) are 100 percent for the first year of operation, 50 percent for the second year, and 25 percent for the third.

Earlier this week, Senator Kaiser’s piece of legislation passed the chamber with a party-line 16-12 vote – with two Democrat Senators not voting (Burch and Gonzales). This action followed two, prior partisan votes in Senate Committees– first in the Finance Committee back in February, where SB 1559 cleared 4-3; and in the Rules Committee, 4-3.

The Joint Legislative Budget Committee (JLBC) previously published data from the U.S. Census Bureau’s Business Formation Statistics, showing that there were 7,919 business formations in Arizona in 2022. The JLBC also projected that “the number of new businesses will grow to 8,523 in 2023, 9,173 in 2024, 9,872 in 2025, and 17,561 in 2026.”

Earlier in the Senate Finance Committee, Democrat Senator Mitzi Epstein explained why she was voting against the transmission of the bill to the full chamber, saying that though she was a small business owner and understood the need for these businesses to receive help and access to resources, she believed the provisions of this legislation would be “ripe for abuse.” She feared that SB 1559 would “create a whole new industry” of entrepreneurs helping small businesses take advantage of the tax and fee incentives provided by this proposal (if enacted).

In the committee, Senator Kaiser, the bill’s sponsor, touted his previous experience as a business owner and empathized with young business owners (especially those businesses under five years old) trying to keep their operation afloat and financed in the early years. He stated that “we need to really support our young businesses as much as possible. They do produce the most new jobs compared to existing small businesses and large businesses, and whatever we can do to help them survive and thrive is going to be helpful.”

Another Democrat Senator, Brian Fernandez, told the Finance Committee that he was a no, but he possibly could be swayed to flip his position if there were changes to the bill, inferring that his suggested tweaks mirrored the concerns expressed by his colleague, Senator Epstein.

Representatives from the Arizona Firearms Industry Trade Association and North Phoenix Chamber of Commerce supported this legislation through the Senate process, while a representative for the Arizona Center for Economic Progress registered opposition to the bill.

Before the vote on the Senate floor, the Arizona Senate Democrats Caucus tweeted that “SB 1559 is another handout for businesses,” and warned that “a new business income tax subtraction could cost Arizona’s General Fund an estimated $34.3M in FY25, $36.5M in FY26, and $38.9M in FY27.”

SB 1559 now heads to the Arizona House of Representatives for consideration.

Daniel Stefanski is a reporter for AZ Free News. You can send him news tips using this link.