By Jonathan Eberle |

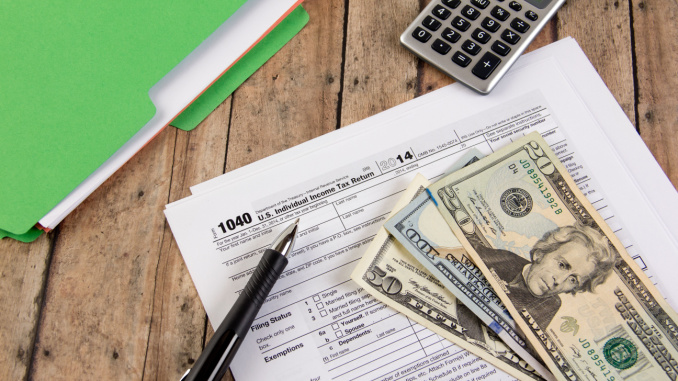

As Arizona counties finalize their budgets for Fiscal Year 2026, the majority are preparing to raise property taxes, with 11 of the state’s 15 counties proposing increases totaling nearly $54.8 million, according to the Arizona Tax Research Association’s (ATRA) July 2025 newsletter. The moves come amid population growth, infrastructure demands, and rising costs, but they have also triggered requirements under Arizona’s Truth in Taxation (TNT) law aimed at ensuring transparency.

ATRA’s analysis reveals that under state law, primary property taxes — which fund the general operations of county governments — are subject to TNT provisions. These rules require counties to notify taxpayers if their proposed tax levy exceeds the previous year’s amount, excluding new construction. Notifications must be published in newspapers of general circulation, and a public hearing must be held before any vote to approve the increase.

TNT also applies to some countywide special taxing districts, including those for libraries, flood control, and public health. While counties are allowed to raise taxes up to a constitutional limit — 2% above the previous year’s levy, plus new construction — only Apache and Coconino counties currently tax at that maximum level.

According to ATRA, of the counties planning tax hikes, Pima County stands out with the largest proposed increase: $33 million. This includes a nearly 25-cent hike in the primary property tax rate above TNT limits. Pima is also planning to exceed TNT thresholds for both its flood control and library districts.

Maricopa County, Arizona’s most populous, is proposing its first primary property tax increase in five years — not by changing the rate, but by holding it steady. Due to growth in the tax base, this would still result in a $12.5 million increase, exclusive of new construction.

In Coconino County, library district taxes are slated to rise 11.5% over TNT, generating approximately $780,000 in additional revenue. The county also plans to levy the maximum amounts for its primary property tax, as well as for its flood control and public health districts. Altogether, Coconino’s tax increase would total around $1.8 million.

Mohave County is eyeing a 7% increase in primary property taxes, which would raise about $3.2 million. Four counties — Graham, Greenlee, La Paz, and Pinal — have opted not to increase property taxes this fiscal year, bucking the statewide trend.

County officials say the proposed increases are necessary to sustain essential public services amid rising costs and growing populations. Still, the hikes are expected to generate scrutiny from taxpayers, especially in counties proposing large percentage increases or exceeding TNT thresholds.

Jonathan Eberle is a reporter for AZ Free News. You can send him news tips using this link.