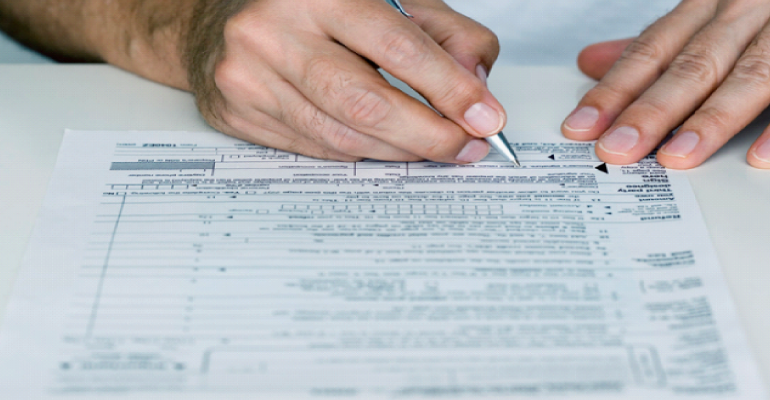

PHOENIX – On Wednesday, the House Ways and Means Committee approved legislation that revises Arizona tax structure for taxpayers and protects small business from over taxation by the federal government, without impacting the state general fund. The vote on HB 2838, sponsored by Rep. Joseph Chaplik, was divided along party lines.

In November 2020, the Internal Revenue Service issued guidance (Notice 2020-75) that pass-through entity businesses may claim deductions above the $10,000 State and Local Tax (SALT) cap. In response, at least seven states have imposed a new tax structure at the pass-through entity level permitting this deduction as intended by the federal government. Under HB 2838, Arizona would join those other states, providing small businesses significant potential tax savings.

“Small businesses are the backbone of the Arizona economy, and I will do everything in my power to protect them,” said Chaplik. “As Arizona businesses recover from an unprecedented economic downturn, I remain committed to providing them every opportunity to thrive in this challenging environment. HB 2838 frees up critical capital for business owners and doesn’t cost the state a dime in tax revenue.

“Republicans voted to help all businesses with tax relief without negatively impacting our state revenues. Democrats voted ‘no’ and are not willing to help their businesses in their districts,” claimed Chaplik.

All 31 members of the House Republican Caucus have signed their support for HB 2838. It will next be considered by the whole House.